Form St-1 Exemption Licence Under Section 5 Of The Jammu And Kashmir General Sales Tax, 1962

ADVERTISEMENT

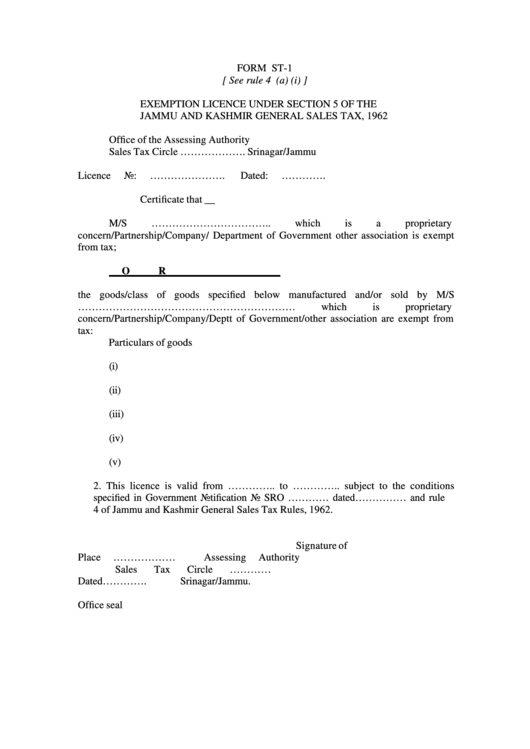

FORM ST-1

[ See rule 4 (a) (i) ]

EXEMPTION LICENCE UNDER SECTION 5 OF THE

JAMMU AND KASHMIR GENERAL SALES TAX, 1962

Office of the Assessing Authority

Sales Tax Circle ………………. Srinagar/Jammu

Licence No: ………………….

Dated: ………….

Certificate that __

M/S

……………………………..

which

is

a

proprietary

concern/Partnership/Company/ Department of Government other association is exempt

from tax;

OR

the goods/class of goods specified below manufactured and/or sold by M/S

………………………………………………………

which

is

proprietary

concern/Partnership/Company/Deptt of Government/other association are exempt from

tax:

Particulars of goods

(i)

(ii)

(iii)

(iv)

(v)

2. This licence is valid from ………….. to ………….. subject to the conditions

specified in Government Notification No SRO ………… dated…………… and rule

4 of Jammu and Kashmir General Sales Tax Rules, 1962.

Signature of

Place ………………

Assessing Authority

Sales Tax Circle …………

Dated………….

Srinagar/Jammu.

Office seal

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1