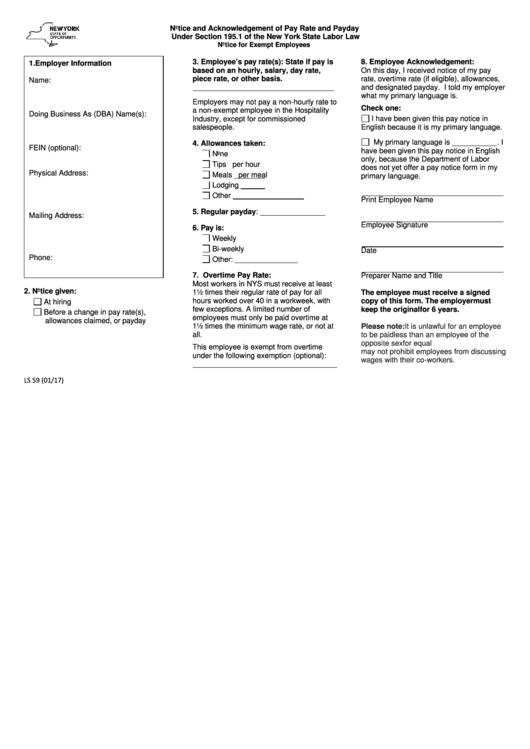

Form Ls 59 - Notice And Acknowledgement Of Pay Rate And Payday

ADVERTISEMENT

Notice and Acknowledgement of Pay Rate and Payday

Under Section 195.1 of the New York State Labor Law

Notice for Exempt Employees

3. Employee’s pay rate(s): State if pay is

8. Employee Acknowledgement:

1. Employer Information

based on an hourly, salary, day rate,

On this day, I received notice of my pay

piece rate, or other basis.

rate, overtime rate (if eligible), allowances,

Name:

and designated payday. I told my employer

what my primary language is.

Employers may not pay a non-hourly rate to

Check one:

a non-exempt employee in the Hospitality

Doing Business As (DBA) Name(s):

Industry, except for commissioned

I have been given this pay notice in

salespeople.

English because it is my primary language.

My primary language is

. I

4. Allowances taken:

FEIN (optional):

have been given this pay notice in English

None

only, because the Department of Labor

Tips

per hour

does not yet offer a pay notice form in my

Physical Address:

Meals

per meal

primary language.

Lodging

Other

Print Employee Name

5. Regular payday:

Mailing Address:

Employee Signature

6. Pay is:

Weekly

Bi-weekly

Date

Phone:

Other:

7. Overtime Pay Rate:

Preparer Name and Title

Most workers in NYS must receive at least

2. Notice given:

1½ times their regular rate of pay for all

The employee must receive a signed

hours worked over 40 in a workweek, with

copy of this form. The employer must

At hiring

few exceptions. A limited number of

keep the original for 6 years.

Before a change in pay rate(s),

employees must only be paid overtime at

allowances claimed, or payday

1½ times the minimum wage rate, or not at

Please note: It is unlawful for an employee

all.

to be paid less than an employee of the

opposite sex for equal work. Employers also

This employee is exempt from overtime

may not prohibit employees from discussing

under the following exemption (optional):

wages with their co-workers.

LS 59 (01/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1