Form Td1 - Personal Tax Credits Return - 2017

ADVERTISEMENT

Protected B

when completed

2017 Personal Tax Credits Return

TD1

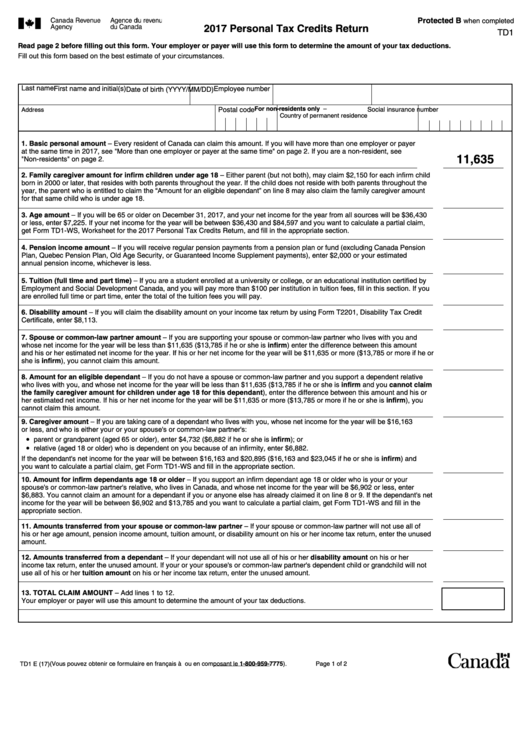

Read page 2 before filling out this form. Your employer or payer will use this form to determine the amount of your tax deductions.

Fill out this form based on the best estimate of your circumstances.

Last name

First name and initial(s)

Employee number

Date of birth (YYYY/MM/DD)

For non-residents only –

Postal code

Social insurance number

Address

Country of permanent residence

1. Basic personal amount – Every resident of Canada can claim this amount. If you will have more than one employer or payer

at the same time in 2017, see "More than one employer or payer at the same time" on page 2. If you are a non-resident, see

11,635

"Non-residents" on page 2.

2. Family caregiver amount for infirm children under age 18 – Either parent (but not both), may claim $2,150 for each infirm child

born in 2000 or later, that resides with both parents throughout the year. If the child does not reside with both parents throughout the

year, the parent who is entitled to claim the “Amount for an eligible dependant” on line 8 may also claim the family caregiver amount

for that same child who is under age 18.

3. Age amount – If you will be 65 or older on December 31, 2017, and your net income for the year from all sources will be $36,430

or less, enter $7,225. If your net income for the year will be between $36,430 and $84,597 and you want to calculate a partial claim,

get Form TD1-WS, Worksheet for the 2017 Personal Tax Credits Return, and fill in the appropriate section.

4. Pension income amount – If you will receive regular pension payments from a pension plan or fund (excluding Canada Pension

Plan, Quebec Pension Plan, Old Age Security, or Guaranteed Income Supplement payments), enter $2,000 or your estimated

annual pension income, whichever is less.

5. Tuition (full time and part time) – If you are a student enrolled at a university or college, or an educational institution certified by

Employment and Social Development Canada, and you will pay more than $100 per institution in tuition fees, fill in this section. If you

are enrolled full time or part time, enter the total of the tuition fees you will pay.

6. Disability amount – If you will claim the disability amount on your income tax return by using Form T2201, Disability Tax Credit

Certificate, enter $8,113.

7. Spouse or common-law partner amount – If you are supporting your spouse or common-law partner who lives with you and

whose net income for the year will be less than $11,635 ($13,785 if he or she is infirm) enter the difference between this amount

and his or her estimated net income for the year. If his or her net income for the year will be $11,635 or more ($13,785 or more if he or

she is infirm), you cannot claim this amount.

8. Amount for an eligible dependant – If you do not have a spouse or common-law partner and you support a dependent relative

who lives with you, and whose net income for the year will be less than $11,635 ($13,785 if he or she is infirm and you cannot claim

the family caregiver amount for children under age 18 for this dependant), enter the difference between this amount and his or

her estimated net income. If his or her net income for the year will be $11,635 or more ($13,785 or more if he or she is infirm), you

cannot claim this amount.

9. Caregiver amount – If you are taking care of a dependant who lives with you, whose net income for the year will be $16,163

or less, and who is either your or your spouse's or common-law partner's:

•

parent or grandparent (aged 65 or older), enter $4,732 ($6,882 if he or she is infirm); or

•

relative (aged 18 or older) who is dependent on you because of an infirmity, enter $6,882.

If the dependant's net income for the year will be between $16,163 and $20,895 ($16,163 and $23,045 if he or she is infirm) and

you want to calculate a partial claim, get Form TD1-WS and fill in the appropriate section.

10. Amount for infirm dependants age 18 or older – If you support an infirm dependant age 18 or older who is your or your

spouse's or common-law partner's relative, who lives in Canada, and whose net income for the year will be $6,902 or less, enter

$6,883. You cannot claim an amount for a dependant if you or anyone else has already claimed it on line 8 or 9. If the dependant's net

income for the year will be between $6,902 and $13,785 and you want to calculate a partial claim, get Form TD1-WS and fill in the

appropriate section.

11. Amounts transferred from your spouse or common-law partner – If your spouse or common-law partner will not use all of

his or her age amount, pension income amount, tuition amount, or disability amount on his or her income tax return, enter the unused

amount.

12. Amounts transferred from a dependant – If your dependant will not use all of his or her disability amount on his or her

income tax return, enter the unused amount. If your or your spouse's or common-law partner's dependent child or grandchild will not

use all of his or her tuition amount on his or her income tax return, enter the unused amount.

13. TOTAL CLAIM AMOUNT – Add lines 1 to 12.

Your employer or payer will use this amount to determine the amount of your tax deductions.

Page 1 of 2

TD1 E (17)

(Vous pouvez obtenir ce formulaire en français à

arc.gc.ca/formulaires

ou en composant le 1-800-959-7775).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2