Line Instructions For Form It-201-Att, Other Tax Credits And Taxes

ADVERTISEMENT

109

Instructions for Form IT-201-ATT

Need help? Go to or see the back cover.

Line instructions for Form IT-201-ATT, Other Tax Credits and Taxes

Purpose of Form IT-201-ATT

The Other credits and taxes chart on pages 111 and 112 lists

other credits you may claim and other taxes you may have to

You must complete Form IT-201-ATT and attach it to your

pay, along with credit code numbers, where applicable, and

Form IT-201 if:

the line reference for Form IT-201-ATT.

• you are claiming other New York State, New York City, or

Find the credits and taxes that apply to you. Complete

Yonkers credits listed in the chart on pages 111 and 112

the additional credit forms as indicated. Enter the money

(credits that are not computed directly on Form IT-201); or

amounts on the appropriate lines and the code numbers,

where applicable (see example below). You must attach

• you are subject to other New York State or New York City

all applicable credit forms and tax computations to

taxes.

Form IT-201.

Instructions

See specific line instructions for lines 1, 9, and 22, and the

Enter your name and social security number as it is listed on

special instructions for Section B, below and on page 110.

your Form IT-201. If you are filing a joint return, enter both

names and use the social security number of the taxpayer

listed first on your Form IT-201.

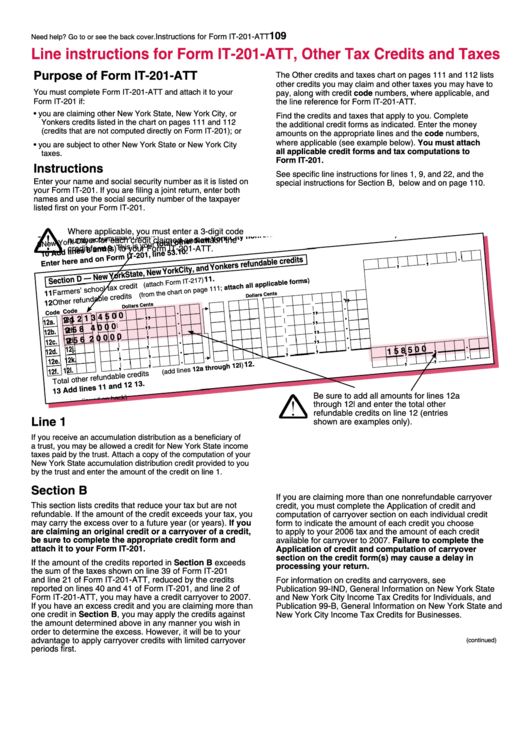

Where applicable, you must enter a 3-digit code

number for each credit claimed and attach the

credit form(s) to your Form IT-201-ATT.

Be sure to add all amounts for lines 12a

through 12l and enter the total other

refundable credits on line 12 (entries

Line 1

shown are examples only).

If you receive an accumulation distribution as a beneficiary of

a trust, you may be allowed a credit for New York State income

taxes paid by the trust. Attach a copy of the computation of your

New York State accumulation distribution credit provided to you

by the trust and enter the amount of the credit on line 1.

Section B

If you are claiming more than one nonrefundable carryover

This section lists credits that reduce your tax but are not

credit, you must complete the Application of credit and

refundable. If the amount of the credit exceeds your tax, you

computation of carryover section on each individual credit

may carry the excess over to a future year (or years). If you

form to indicate the amount of each credit you choose

are claiming an original credit or a carryover of a credit,

to apply to your 2006 tax and the amount of each credit

be sure to complete the appropriate credit form and

available for carryover to 2007. Failure to complete the

attach it to your Form IT-201.

Application of credit and computation of carryover

section on the credit form(s) may cause a delay in

If the amount of the credits reported in Section B exceeds

processing your return.

the sum of the taxes shown on line 39 of Form IT-201

and line 21 of Form IT-201-ATT, reduced by the credits

For information on credits and carryovers, see

reported on lines 40 and 41 of Form IT-201, and line 2 of

Publication 99-IND, General Information on New York State

Form IT-201-ATT, you may have a credit carryover to 2007.

and New York City Income Tax Credits for Individuals, and

If you have an excess credit and you are claiming more than

Publication 99-B, General Information on New York State and

one credit in Section B, you may apply the credits against

New York City Income Tax Credits for Businesses.

the amount determined above in any manner you wish in

order to determine the excess. However, it will be to your

advantage to apply carryover credits with limited carryover

(continued)

periods first.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4