950611

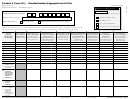

Schedule R (Form 941) (Rev. 1-2011)

Section references are to the Internal Revenue Code unless otherwise

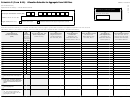

• Total income tax withheld from wages, tips, and other compensation

noted.

(line 3 of Form 941) allocated to the listed client EIN.

• Total social security and Medicare taxes (line 5d of Form 941)

General Instructions

allocated to the listed client EIN.

• Total taxes after adjustments from line 10 of Form 941 (line 8 for

Purpose of Schedule R (Form 941)

quarters ending before January 31, 2011) allocated to the listed client

EIN.

Use Schedule R (Form 941) to allocate the aggregate information

• Advance earned income credit (EIC) payments from line 9 of Form 941

reported on Form 941 to each client. If you have more than 15 clients,

(for quarters ending before January 31, 2011) allocated to the listed

complete as many Continuation Sheets for Schedule R (Form 941) as

client EIN.

necessary. Attach Schedule R (Form 941), including any Continuation

Sheets, to your aggregate Form 941 and file it with your return.

• Total deposits and COBRA premium assistance payments for this

quarter from line 13 of Form 941 and amounts paid with this return,

Who Must File?

allocated to the listed client EIN.

You must also report the same information for your employees on line

You must complete Schedule R (Form 941) each time you file an

18 of Schedule R (Form 941).

aggregate Form 941, Employer’s QUARTERLY Federal Tax Return.

Aggregate Forms 941 are filed by agents approved by the IRS under

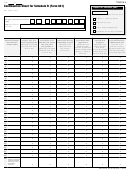

Compare the total of each column on line 19 (including your

section 3504. To request approval to act as an agent for an employer,

information on line 18) of Schedule R (Form 941) to the amounts

you must file Form 2678, Employer/Payer Appointment of Agent, with

reported on the aggregate Form 941. For each column total of Schedule

the IRS. On Schedule R (Form 941), we call those employers your

R (Form 941), the relevant line from Form 941 is noted in the column

clients.

heading.

When Must You File?

If the totals on line 19 of the Schedule R (Form 941) do not match the

totals on Form 941, there is an error that must be corrected before

If you are an aggregate Form 941 filer, file Schedule R (Form 941) with

submitting Form 941 and Schedule R (Form 941).

your aggregate Form 941 every quarter when Form 941 is due.

Paperwork Reduction Act Notice. We ask for the information on

Schedule R (Form 941) to carry out the Internal Revenue laws of the

Specific Instructions

United States. You are required to give us this information. We need it to

ensure that you are complying with these laws and to allow us to figure

Completing Schedule R (Form 941)

and collect the right amount of tax.

You are not required to provide the information requested on a form

Enter Your Business Information

that is subject to the Paperwork Reduction Act unless the form displays

Carefully enter your employer identification number (EIN) and the name

a valid OMB control number. Books or records relating to a form or its

of your business at the top of the schedule. Make sure they exactly

instructions must be retained as long as their contents may become

match the EIN and name shown on the attached Form 941.

material in the administration of any Internal Revenue law. Generally, tax

returns and return information are confidential, as required by section

Calendar Year

6103.

Enter the calendar year that applies to the quarter checked.

The time needed to complete and file Schedule R (Form 941) will vary

Check the Box for the Quarter

depending on individual circumstances. The estimated average time is:

Recordkeeping

Check the appropriate box of the quarter for which you are filing

.

.

.

.

.

.

.

.

.

.

.

12 hrs., 26 min.

Schedule R (Form 941). Make sure the quarter checked on the top of the

Learning about the law or the form .

.

.

.

.

.

.

. 12 min.

Schedule R (Form 941) matches the quarter checked on your Form 941.

Preparing, copying, and assembling the form .

.

.

.

. 24 min.

Client and Employee Information

If you have comments concerning the accuracy of these time

estimates or suggestions for making Schedule R (Form 941) simpler, we

On Schedule R (Form 941), including any Continuation Sheets for

would be happy to hear from you. You can email us at

Schedule R (Form 941), you must report the following for each client.

*taxforms@irs.gov. (The asterisk must be included in the address.) Enter

Note. When entering amounts over 999.99 on Schedule R (Form 941),

“Forms Comment” on the subject line. Or write to: Internal Revenue

do not enter commas.

Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP,

1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not

• Your client’s employer identification number (EIN).

send Schedule R (Form 941) to this address. Instead, see Where Should

• Wages, tips, and other compensation (line 2 of Form 941) allocated to

You File? in the Instructions for Form 941.

the listed client EIN.

1

1 2

2 3

3