Employee Hsa Contribution Form

ADVERTISEMENT

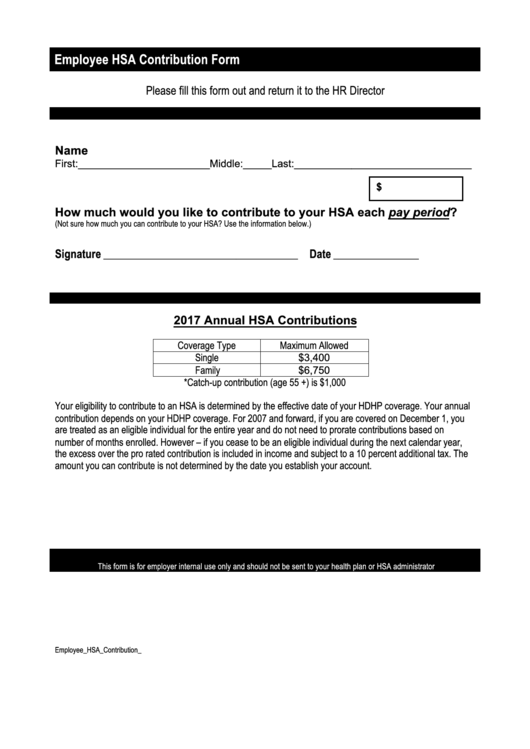

Employee HSA Contribution Form

Please fill this form out and return it to the HR Director

Name

First:_______________________Middle:_____Last:_______________________________

$

How much would you like to contribute to your HSA each pay period?

(Not sure how much you can contribute to your HSA? Use the information below.)

Signature

Date

_________________________________________

__________________

2017 Annual HSA Contributions

Coverage Type

Maximum Allowed

Single

$3,400

Family

$6,750

*Catch-up contribution (age 55 +) is $1,000

Your eligibility to contribute to an HSA is determined by the effective date of your HDHP coverage. Your annual

contribution depends on your HDHP coverage. For 2007 and forward, if you are covered on December 1, you

are treated as an eligible individual for the entire year and do not need to prorate contributions based on

number of months enrolled. However – if you cease to be an eligible individual during the next calendar year,

the excess over the pro rated contribution is included in income and subject to a 10 percent additional tax. The

amount you can contribute is not determined by the date you establish your account.

This form is for employer internal use only and should not be sent to your health plan or HSA administrator

Employee_HSA_Contribution_Form2015.docx

ADVERTISEMENT

0 votes

1

1