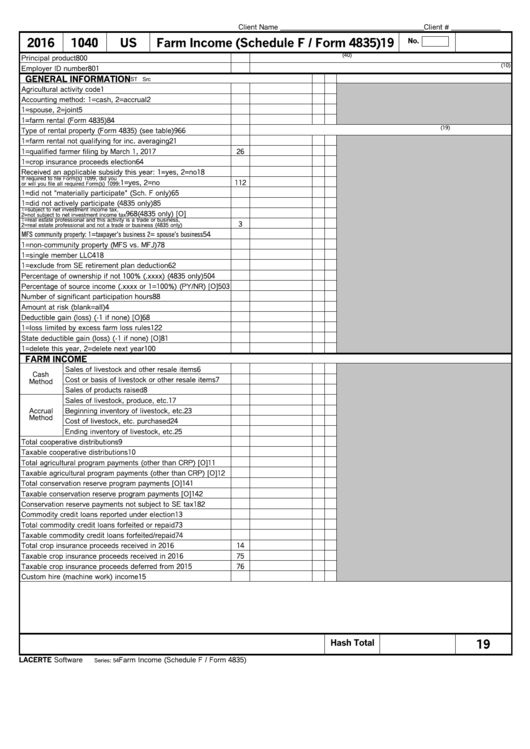

Farm Income (Schedule F/form 4835)

ADVERTISEMENT

Client Name ___________________________________ Client # ____________

2016

1040

US

Farm Income (Schedule F / Form 4835)

19

No.

(40)

Principal product

800

(10)

Employer ID number

801

GENERAL INFORMATION

ST Src

Agricultural activity code

1

Accounting method: 1=cash, 2=accrual

2

1=spouse, 2=joint

5

1=farm rental (Form 4835)

84

(19)

Type of rental property (Form 4835) (see table)

966

1=farm rental not qualifying for inc. averaging

21

1=qualified farmer filing by March 1, 2017

26

1=crop insurance proceeds election

64

Received an applicable subsidy this year: 1=yes, 2=no

18

If required to file Form(s) 1099, did you

1=yes, 2=no

112

or will you file all required Form(s) 1099:

1=did not "materially participate" (Sch. F only)

65

1=did not actively participate (4835 only)

85

1=subject to net investment income tax,

(4835 only) [O]

968

2=not subject to net investment income tax

1=real estate professional and this activity is a trade or business,

3

2=real estate professional and not a trade or business (4835 only)

MFS community property: 1=taxpayer's business 2= spouse's business

54

1=non-community property (MFS vs. MFJ)

78

1=single member LLC

418

1=exclude from SE retirement plan deduction

62

Percentage of ownership if not 100% (.xxxx) (4835 only)

504

Percentage of source income (.xxxx or 1=100%) (PY/NR) [O]

503

Number of significant participation hours

88

Amount at risk (blank=all)

4

Deductible gain (loss) (-1 if none) [O]

68

1=loss limited by excess farm loss rules

122

State deductible gain (loss) (-1 if none) [O]

81

1=delete this year, 2=delete next year

100

FARM INCOME

Sales of livestock and other resale items

6

Cash

Cost or basis of livestock or other resale items

7

Method

Sales of products raised

8

Sales of livestock, produce, etc.

17

Accrual

Beginning inventory of livestock, etc.

23

Method

Cost of livestock, etc. purchased

24

Ending inventory of livestock, etc.

25

Total cooperative distributions

9

Taxable cooperative distributions

10

Total agricultural program payments (other than CRP) [O]

11

Taxable agricultural program payments (other than CRP) [O]

12

Total conservation reserve program payments [O]

141

Taxable conservation reserve program payments [O]

142

Conservation reserve payments not subject to SE tax

182

Commodity credit loans reported under election

13

Total commodity credit loans forfeited or repaid

73

Taxable commodity credit loans forfeited/repaid

74

Total crop insurance proceeds received in 2016

14

Taxable crop insurance proceeds received in 2016

75

Taxable crop insurance proceeds deferred from 2015

76

Custom hire (machine work) income

15

Hash Total

19

LACERTE Software

Farm Income (Schedule F / Form 4835)

Series: 54

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1