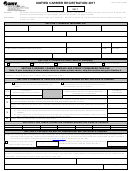

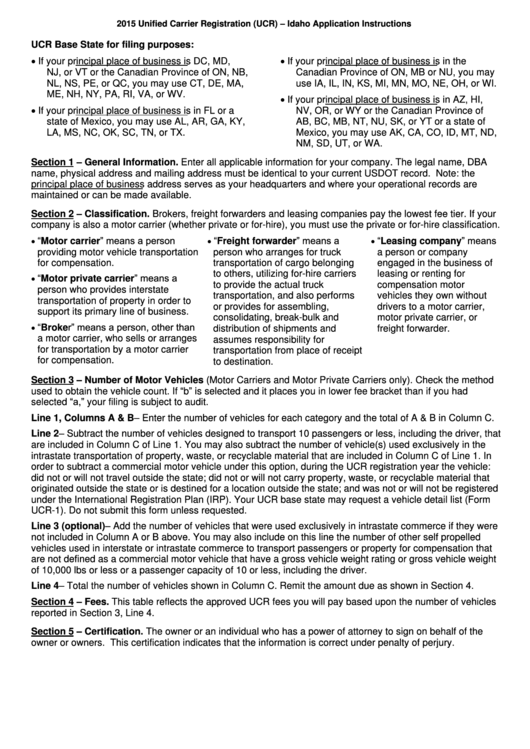

2015 Unified Carrier Registration (UCR) – Idaho Application Instructions

UCR Base State for filing purposes:

If your principal place of business is DC, MD,

If your principal place of business is in the

NJ, or VT or the Canadian Province of ON, NB,

Canadian Province of ON, MB or NU, you may

NL, NS, PE, or QC, you may use CT, DE, MA,

use IA, IL, IN, KS, MI, MN, MO, NE, OH, or WI.

ME, NH, NY, PA, RI, VA, or WV.

If your principal place of business is in AZ, HI,

If your principal place of business is in FL or a

NV, OR, or WY or the Canadian Province of

state of Mexico, you may use AL, AR, GA, KY,

AB, BC, MB, NT, NU, SK, or YT or a state of

LA, MS, NC, OK, SC, TN, or TX.

Mexico, you may use AK, CA, CO, ID, MT, ND,

NM, SD, UT, or WA.

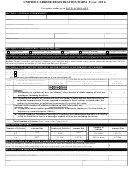

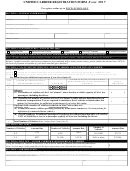

Section 1 – General Information. Enter all applicable information for your company. The legal name, DBA

name, physical address and mailing address must be identical to your current USDOT record. Note: the

principal place of business address serves as your headquarters and where your operational records are

maintained or can be made available.

Section 2 – Classification. Brokers, freight forwarders and leasing companies pay the lowest fee tier. If your

company is also a motor carrier (whether private or for-hire), you must use the private or for-hire classification.

“Motor carrier” means a person

“Freight forwarder” means a

“Leasing company” means

providing motor vehicle transportation

person who arranges for truck

a person or company

for compensation.

transportation of cargo belonging

engaged in the business of

to others, utilizing for-hire carriers

leasing or renting for

“Motor private carrier” means a

to provide the actual truck

compensation motor

person who provides interstate

transportation, and also performs

vehicles they own without

transportation of property in order to

or provides for assembling,

drivers to a motor carrier,

support its primary line of business.

consolidating, break-bulk and

motor private carrier, or

“Broker” means a person, other than

distribution of shipments and

freight forwarder.

a motor carrier, who sells or arranges

assumes responsibility for

for transportation by a motor carrier

transportation from place of receipt

for compensation.

to destination.

Section 3 – Number of Motor Vehicles (Motor Carriers and Motor Private Carriers only). Check the method

used to obtain the vehicle count. If “b” is selected and it places you in lower fee bracket than if you had

selected “a,” your filing is subject to audit.

Line 1, Columns A & B – Enter the number of vehicles for each category and the total of A & B in Column C.

Line 2 – Subtract the number of vehicles designed to transport 10 passengers or less, including the driver, that

are included in Column C of Line 1. You may also subtract the number of vehicle(s) used exclusively in the

intrastate transportation of property, waste, or recyclable material that are included in Column C of Line 1. In

order to subtract a commercial motor vehicle under this option, during the UCR registration year the vehicle:

did not or will not travel outside the state; did not or will not carry property, waste, or recyclable material that

originated outside the state or is destined for a location outside the state; and was not or will not be registered

under the International Registration Plan (IRP). Your UCR base state may request a vehicle detail list (Form

UCR-1). Do not submit this form unless requested.

Line 3 (optional) – Add the number of vehicles that were used exclusively in intrastate commerce if they were

not included in Column A or B above. You may also include on this line the number of other self propelled

vehicles used in interstate or intrastate commerce to transport passengers or property for compensation that

are not defined as a commercial motor vehicle that have a gross vehicle weight rating or gross vehicle weight

of 10,000 lbs or less or a passenger capacity of 10 or less, including the driver.

Line 4 – Total the number of vehicles shown in Column C. Remit the amount due as shown in Section 4.

Section 4 – Fees. This table reflects the approved UCR fees you will pay based upon the number of vehicles

reported in Section 3, Line 4.

Section 5 – Certification. The owner or an individual who has a power of attorney to sign on behalf of the

owner or owners. This certification indicates that the information is correct under penalty of perjury.

1

1 2

2