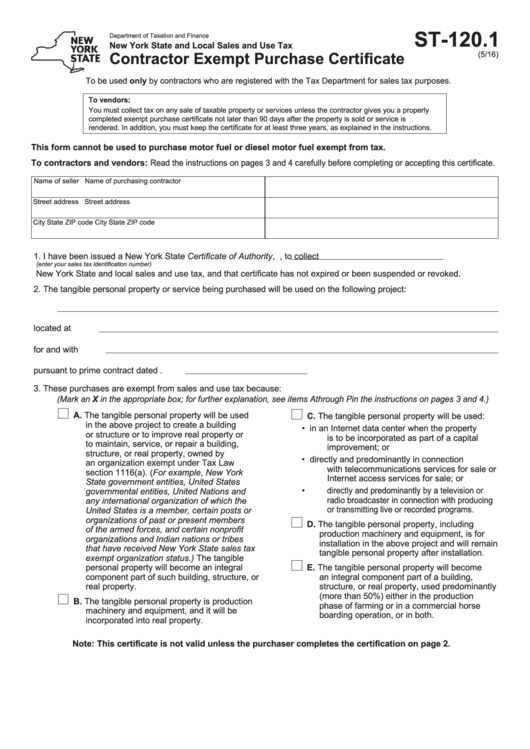

ST-120.1

Department of Taxation and Finance

New York State and Local Sales and Use Tax

Contractor Exempt Purchase Certificate

(5/16)

To be used only by contractors who are registered with the Tax Department for sales tax purposes.

To vendors:

You must collect tax on any sale of taxable property or services unless the contractor gives you a properly

completed exempt purchase certificate not later than 90 days after the property is sold or service is

rendered. In addition, you must keep the certificate for at least three years, as explained in the instructions.

This form cannot be used to purchase motor fuel or diesel motor fuel exempt from tax.

To contractors and vendors: Read the instructions on pages 3 and 4 carefully before completing or accepting this certificate.

Name of seller

Name of purchasing contractor

Street address

Street address

City

State

ZIP code

City

State

ZIP code

1.

I have been issued a New York State Certificate of Authority,

, to collect

(enter your sales tax identification number)

New York State and local sales and use tax, and that certificate has not expired or been suspended or revoked.

2.

The tangible personal property or service being purchased will be used on the following project:

located at

for and with

pursuant to prime contract dated

.

3.

These purchases are exempt from sales and use tax because:

(Mark an X in the appropriate box; for further explanation, see items A through P in the instructions on pages 3 and 4.)

A. The tangible personal property will be used

C. The tangible personal property will be used:

in the above project to create a building

• in an Internet data center when the property

or structure or to improve real property or

is to be incorporated as part of a capital

to maintain, service, or repair a building,

improvement; or

structure, or real property, owned by

• directly and predominantly in connection

an organization exempt under Tax Law

with telecommunications services for sale or

section 1116(a). (For example, New York

Internet access services for sale; or

State government entities, United States

• directly and predominantly by a television or

governmental entities, United Nations and

radio broadcaster in connection with producing

any international organization of which the

or transmitting live or recorded programs.

United States is a member, certain posts or

organizations of past or present members

D. The tangible personal property, including

of the armed forces, and certain nonprofit

production machinery and equipment, is for

organizations and Indian nations or tribes

installation in the above project and will remain

that have received New York State sales tax

tangible personal property after installation.

exempt organization status.) The tangible

personal property will become an integral

E. The tangible personal property will become

component part of such building, structure, or

an integral component part of a building,

real property.

structure, or real property, used predominantly

(more than 50%) either in the production

B. The tangible personal property is production

phase of farming or in a commercial horse

machinery and equipment, and it will be

boarding operation, or in both.

incorporated into real property.

Note: This certificate is not valid unless the purchaser completes the certification on page 2.

1

1 2

2 3

3 4

4