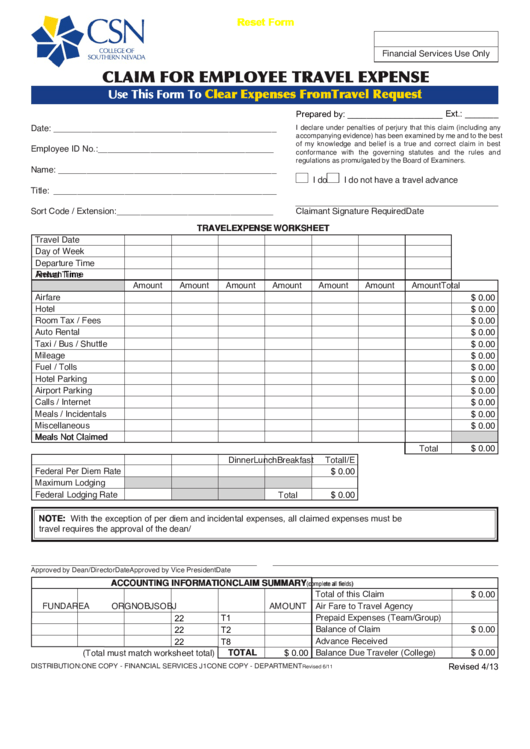

Reset Form

Financial Services Use Only

CLAIM FOR EMPLOYEE TRAVEL EXPENSE

Clear Expenses From Travel Request

Use This Form To

Prepared by: ____________________ Ext.: _______

Date: _______________________________________________

I declare under penalties of perjury that this claim (including any

accompanying evidence) has been examined by me and to the best

of my knowledge and belief is a true and correct claim in best

Employee ID No.: _____________________________________

conformance with the governing statutes and the rules and

regulations as promulgated by the Board of Examiners.

Name: ______________________________________________

I do

I do not have a travel advance

Title: _______________________________________________

Claimant Signature Required

Date

Sort Code / Extension: _________________________________

TRAVEL EXPENSE WORKSHEET

Travel Date

Day of Week

Departure Time

Arrival Time

Return Time

Amount

Amount

Amount

Amount

Amount

Amount

Amount

Total

Airfare

Hotel

$ 0.00

Room Tax / Fees

$ 0.00

$ 0.00

Auto Rental

$ 0.00

Taxi / Bus / Shuttle

$ 0.00

Mileage

$ 0.00

Fuel / Tolls

Hotel Parking

$ 0.00

Airport Parking

$ 0.00

$ 0.00

Calls / Internet

$ 0.00

Meals / Incidentals

$ 0.00

Miscellaneous

$ 0.00

Meals Not Claimed

Total

$ 0.00

Breakfast

Lunch

Dinner

I/E

Total

Federal Per Diem Rate

Maximum Lodging

$ 0.00

Federal Lodging Rate

Total

$ 0.00

NOTE: With the exception of per diem and incidental expenses, all claimed expenses must be documented. In-state

travel requires the approval of the dean/director. Out-of-state travel also requires the approval of the vice president.

Approved by Dean/Director

Date

Approved by Vice President

Date

ACCOUNTING INFORMATION

CLAIM SUMMARY

Total of this Claim

(complete ll fields)

FUND

AREA

ORGN

OBJ

SOBJ

AMOUNT

Air Fare to Travel Agency

$ 0.00

Prepaid Expenses (Team/Group)

T1

22

Balance of Claim

22

T2

$ 0.00

Advance Received

22

T8

(Total must match worksheet total)

Balance Due Traveler (College)

TOTAL

$ 0.00

$ 0.00

DISTRIBUTION: ONE COPY - FINANCIAL SERVICES J1C

ONE COPY - DEPARTMENT

Revised 6/11

Revised 4/13

1

1