Application To The Registering/transferring Authority

ADVERTISEMENT

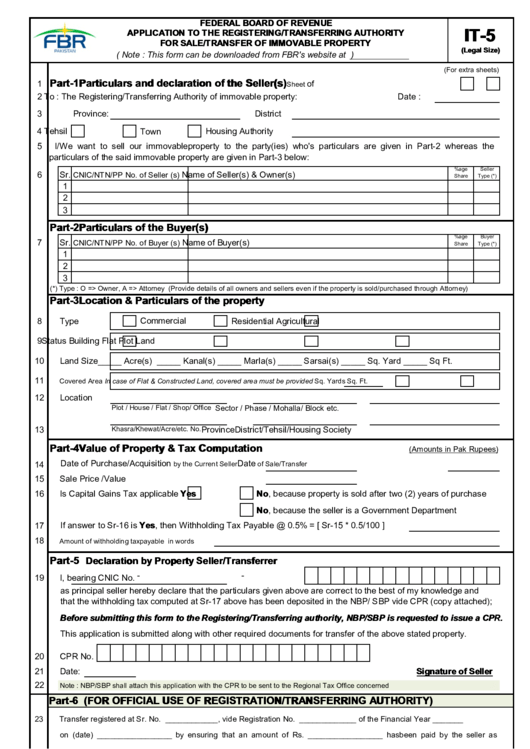

FEDERAL BOARD OF REVENUE

IT-5

APPLICATION TO THE REGISTERING/TRANSFERRING AUTHORITY

FOR SALE/TRANSFER OF IMMOVABLE PROPERTY

(Legal Size)

( Note : This form can be downloaded from FBR's website at )

(For extra sheets)

Part-1 Particulars and declaration of the Seller(s)

1

of

Sheet

2

To : The Registering/Transferring Authority of immovable property:

Date :

3

Province:

District

4

Tehsil

Town

Housing Authority

5

I/We want to sell our immovable property to the party(ies) who's particulars are given in Part-2 whereas the

particulars of the said immovable property are given in Part-3 below:

%age

Seller

6

Sr.

Name of Seller(s) & Owner(s)

CNIC/NTN/PP No. of Seller (s)

Share

Type (*)

1

2

3

Part-2 Particulars of the Buyer(s)

%age

Buyer

7

Sr.

Name of Buyer(s)

CNIC/NTN/PP No. of Buyer (s)

Share

Type (*)

1

2

3

(*) Type : O => Owner, A => Attorney

(Provide details of all owners and sellers even if the property is sold/purchased through Attorney)

Part-3 Location & Particulars of the property

8

Type

Commercial

Residential

Agricultural

9

Status

Building

Flat

Plot

Land

10

Land Size

_____ Acre(s) _____ Kanal(s) _____ Marla(s) _____ Sarsai(s) _____ Sq. Yard _____ Sq Ft.

11

Covered Area

In case of Flat & Constructed Land, covered area must be provided

Sq. Yards

Sq. Ft.

12

Location

Plot / House / Flat / Shop/ Office No.

Street / Lane etc. No.

Sector / Phase / Mohalla/ Block etc.

Khasra/Khewat/Acre/etc. No.

13

Province

District/Tehsil/Housing Society

Part-4 Value of Property & Tax Computation

(Amounts in Pak Rupees)

Date of Purchase/Acquisition

Date

14

by the Current Seller

of Sale/Transfer

15

Sale Price /Value

16

Is Capital Gains Tax applicable

Yes

No, because property is sold after two (2) years of purchase

No, because the seller is a Government Department

17

If answer to Sr-16 is Yes, then Withholding Tax Payable @ 0.5% = [ Sr-15 * 0.5/100 ]

18

Amount of withholding taxpayable in words

`

Part-5

Declaration by Property Seller/Transferrer

-

-

19

I,

bearing CNIC No.

as principal seller hereby declare that the particulars given above are correct to the best of my knowledge and

that the withholding tax computed at Sr-17 above has been deposited in the NBP/ SBP vide CPR (copy attached);

Before submitting this form to the Registering/Transferring authority, NBP/SBP is requested to issue a CPR.

This application is submitted along with other required documents for transfer of the above stated property.

20

CPR No.

21

Date:

Signature of Seller

22

Note : NBP/SBP shall attach this application with the CPR to be sent to the Regional Tax Office concerned

Part-6 (FOR OFFICIAL USE OF REGISTRATION/TRANSFERRING AUTHORITY)

23

Transfer registered at Sr. No. ____________, vide Registration No. _____________ of the Financial Year _______

on (date) _________________ by ensuring that an amount of Rs. _________________ has been paid by the seller as

withholding tax u/s 236C of the Income Tax Ordinance 2001 vide Bank CPR No referred above. Copy duly signed and

stamped has been placed in the official record and one copy sent to the Regional Tax Office concerned.

24

Official Seal of the Authority

Signature of Registration Authority

Distribution : 1) Original for Registering/Transferring authority

2) Seller

3) Buyer

4) Concerned Regional Tax Office of FBR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1