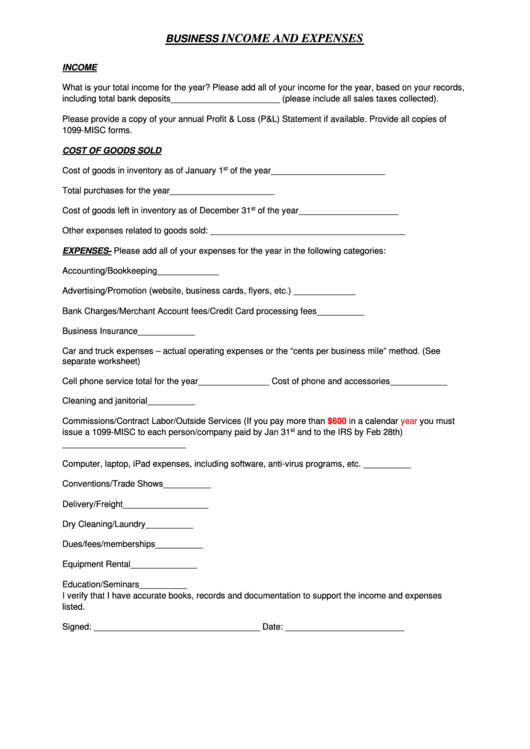

INCOME AND EXPENSES

BUSINESS

INCOME

What is your total income for the year? Please add all of your income for the year, based on your records,

including total bank deposits_______________________ (please include all sales taxes collected).

Please provide a copy of your annual Profit & Loss (P&L) Statement if available. Provide all copies of

1099-MISC forms.

COST OF GOODS SOLD

st

Cost of goods in inventory as of January 1

of the year________________________

Total purchases for the year______________________

st

Cost of goods left in inventory as of December 31

of the year_____________________

Other expenses related to goods sold: _________________________________________

EXPENSES- Please add all of your expenses for the year in the following categories:

Accounting/Bookkeeping_____________

Advertising/Promotion (website, business cards, flyers, etc.) _____________

Bank Charges/Merchant Account fees/Credit Card processing fees__________

Business Insurance____________

Car and truck expenses – actual operating expenses or the “cents per business mile” method. (See

separate worksheet)

Cell phone service total for the year_______________ Cost of phone and accessories____________

Cleaning and janitorial__________

Commissions/Contract Labor/Outside Services (If you pay more than

$600

in a calendar

year

you must

st

issue a 1099-MISC to each person/company paid by Jan 31

and to the IRS by Feb 28th)

__________________________

Computer, laptop, iPad expenses, including software, anti-virus programs, etc. __________

Conventions/Trade Shows__________

Delivery/Freight__________________

Dry Cleaning/Laundry__________

Dues/fees/memberships__________

Equipment Rental______________

Education/Seminars__________

I verify that I have accurate books, records and documentation to support the income and expenses

listed.

Signed: ___________________________________ Date: _________________________

1

1 2

2 3

3