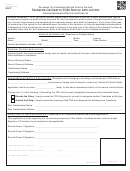

Simple Revocable Transfer On Death (Tod) Deed Page 4

ADVERTISEMENT

HOW DO I NAME BENEFICIARIES? You MUST name your beneficiaries individually, using each

beneficiary’s FULL name. You MAY NOT use general terms to describe beneficiaries, such as “my

children.” For each beneficiary that you name, you should briefly state that person’s relationship to you

(for example, my spouse, my son, my daughter, my friend, etc.).

WHAT IF A BENEFICIARY DIES BEFORE I DO? If all beneficiaries die before you, the TOD deed has no

effect. If a beneficiary dies before you, but other beneficiaries survive you, the share of the deceased

beneficiary will be divided equally between the surviving beneficiaries. If that is not the result you want,

you should not use the TOD deed.

WHAT IS THE EFFECT OF A TOD DEED ON PROPERTY THAT I OWN AS JOINT TENANCY OR

COMMUNITY PROPERTY WITH RIGHT OF SURVIVORSHIP? If you are the first joint tenant or spouse to

die, the deed is VOID and has no effect. The property transfers to your joint tenant or surviving spouse

and not according to this deed. If you are the last joint tenant or spouse to die, the deed takes effect and

controls the ownership of your property when you die. If you do not want these results, do not use this

form. The deed does NOT transfer the share of a co-owner of the property. Any co-owner who wants to

name a TOD beneficiary must complete and RECORD a SEPARATE deed.

CAN I ADD OTHER CONDITIONS ON THE FORM? No. If you do, your beneficiary may need to go to court

to clear title.

IS PROPERTY TRANSFERRED BY THE TOD DEED SUBJECT TO MY DEBTS? Yes.

DOES THE TOD DEED HELP ME TO AVOID GIFT AND ESTATE TAXES? No.

HOW DOES THE TOD DEED AFFECT PROPERTY TAXES? The TOD deed has no effect on your property

taxes until your death. At that time, property tax law applies as it would to any other change of

ownership.

DOES THE TOD DEED AFFECT MY ELIGIBILITY FOR MEDI-CAL? No.

AFTER MY DEATH, WILL MY HOME BE LIABLE FOR REIMBURSEMENT OF THE STATE FOR MEDI-CAL

EXPENDITURES? Your home may be liable for reimbursement. If you have questions, you should consult

an attorney.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4