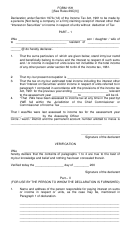

Form No. 15h - Declaration Under Section 197a (1a) Of The Income Tax Act, 1961 To Be Made By A Persons Claiming Receipt Of Interest Other Than "Interest On Securities" Or Income In Respect Of Units Without Deduction Of Tax Page 2

ADVERTISEMENT

2.

Date on which the declaration was furnished by the declarant.

3.

Period for which interest or income in respect of units as the case may be

credited / paid __________________________________________

4.

Amount of interest or income in respect of units, as the case may be

__________________________________________

5.

Rate on which interest or income in respect of units, as the case may be is

credited / paid __________________________________________

Forwarded to the Chief Commissioner or Commissioner of Income Tax _______

____________________________

Signature of the person responsible

For Paying interest other than interest on Securities

/ income in respect of units

Place :

Date:

NOTES

1.

@Give complete postal address

2.

The declaration should be furnished in duplicate

3.

*Delete whichever is not applicable

4.

**Indicate the capacity in which the declaration is furnished on behalf of

Hindu undivided family, association of persons etc.

5.

Before signing the verification the declarant should satisfy himself that the

information furnished in the declaration is true correct and complete in all

respects.

6.

Any persons making a false statement in the declaration shall be liable to

be prosecuted under section 227 of the income tax Act, 1961 and on

conviction be punishable.

i.

in a case where the amount of tax which would have been evaded

if the statement or account had been accepted as true, exceed one

hundred thousand rupees with vigorous imprisonment for a term

which shall not be less than six months but which may extend to

seven years and with fine.

ii.

In any other case, with rigorous imprisonment for a term which shall

not be less than three months but which may extend to three years

and with fine.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2