It-370-Pf-V - New York State Department Of Taxation And Finance Payment Voucher And Instructions For Form It-370-Pf Filed Online

ADVERTISEMENT

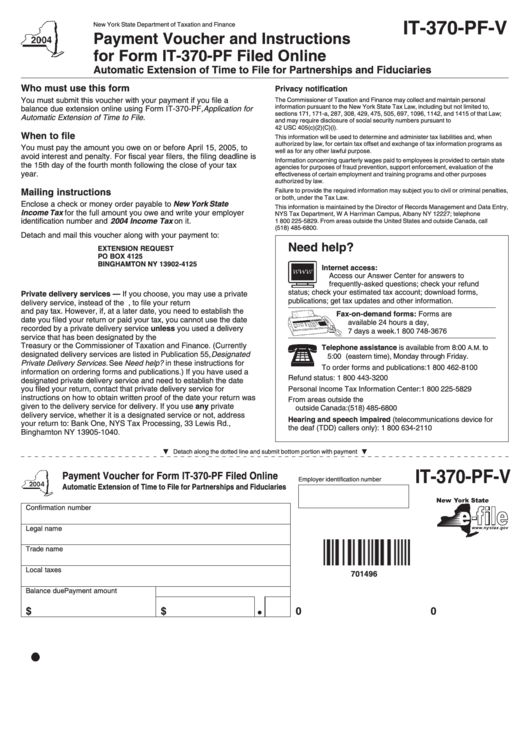

IT-370-PF-V

New York State Department of Taxation and Finance

Payment Voucher and Instructions

for Form IT-370-PF Filed Online

Automatic Extension of Time to File for Partnerships and Fiduciaries

Who must use this form

Privacy notification

You must submit this voucher with your payment if you file a

The Commissioner of Taxation and Finance may collect and maintain personal

information pursuant to the New York State Tax Law, including but not limited to,

balance due extension online using Form IT-370-PF, Application for

sections 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law;

Automatic Extension of Time to File.

and may require disclosure of social security numbers pursuant to

42 USC 405(c)(2)(C)(i).

When to file

This information will be used to determine and administer tax liabilities and, when

authorized by law, for certain tax offset and exchange of tax information programs as

You must pay the amount you owe on or before April 15, 2005, to

well as for any other lawful purpose.

avoid interest and penalty. For fiscal year filers, the filing deadline is

Information concerning quarterly wages paid to employees is provided to certain state

the 15th day of the fourth month following the close of your tax

agencies for purposes of fraud prevention, support enforcement, evaluation of the

year.

effectiveness of certain employment and training programs and other purposes

authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties,

Mailing instructions

or both, under the Tax Law.

Enclose a check or money order payable to New York State

This information is maintained by the Director of Records Management and Data Entry,

Income Tax for the full amount you owe and write your employer

NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone

identification number and 2004 Income Tax on it.

1 800 225-5829. From areas outside the United States and outside Canada, call

(518) 485-6800.

Detach and mail this voucher along with your payment to:

Need help?

EXTENSION REQUEST

PO BOX 4125

BINGHAMTON NY 13902-4125

Internet access:

Access our Answer Center for answers to

frequently-asked questions; check your refund

status; check your estimated tax account; download forms,

Private delivery services — If you choose, you may use a private

publications; get tax updates and other information.

delivery service, instead of the U.S. Postal Service, to file your return

and pay tax. However, if, at a later date, you need to establish the

Fax-on-demand forms: Forms are

date you filed your return or paid your tax, you cannot use the date

available 24 hours a day,

recorded by a private delivery service unless you used a delivery

7 days a week.

1 800 748-3676

service that has been designated by the U.S. Secretary of the

Treasury or the Commissioner of Taxation and Finance. (Currently

Telephone assistance is available from 8:00

. to

A.M

designated delivery services are listed in Publication 55, Designated

5:00

(eastern time), Monday through Friday.

P.M.

Private Delivery Services. See Need help? in these instructions for

To order forms and publications:

1 800 462-8100

information on ordering forms and publications.) If you have used a

Refund status:

1 800 443-3200

designated private delivery service and need to establish the date

you filed your return, contact that private delivery service for

Personal Income Tax Information Center:

1 800 225-5829

instructions on how to obtain written proof of the date your return was

From areas outside the U.S. and

given to the delivery service for delivery. If you use any private

outside Canada:

(518) 485-6800

delivery service, whether it is a designated service or not, address

Hearing and speech impaired (telecommunications device for

your return to: Bank One, NYS Tax Processing, 33 Lewis Rd.,

the deaf (TDD) callers only): 1 800 634-2110

Binghamton NY 13905-1040.

Detach along the dotted line and submit bottom portion with payment

IT-370-PF-V

Payment Voucher for Form IT-370-PF Filed Online

Employer identification number

Automatic Extension of Time to File for Partnerships and Fiduciaries

Confirmation number

Legal name

Trade name

Local taxes

701496

Balance due

Payment amount

$

$

0 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1