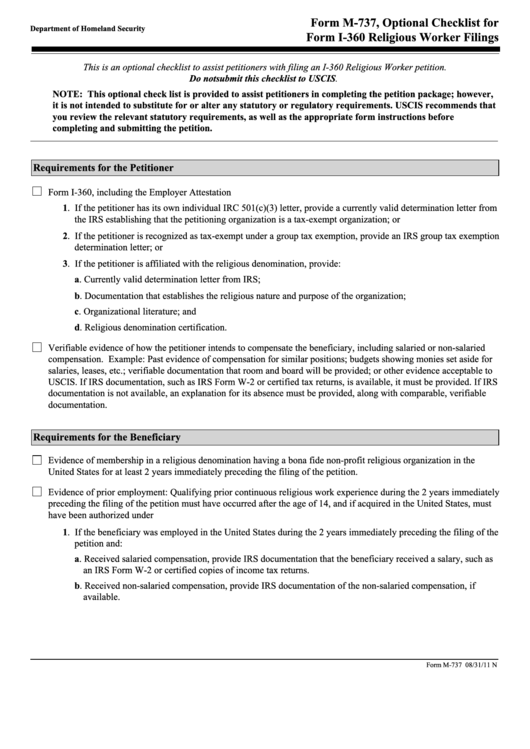

Form M-737, Optional Checklist for

Department of Homeland Security

Form I-360 Religious Worker Filings

U.S. Citizenship and Immigration Services

This is an optional checklist to assist petitioners with filing an I-360 Religious Worker petition.

Do not submit this checklist to USCIS.

NOTE: This optional check list is provided to assist petitioners in completing the petition package; however,

it is not intended to substitute for or alter any statutory or regulatory requirements. USCIS recommends that

you review the relevant statutory requirements, as well as the appropriate form instructions before

completing and submitting the petition.

Requirements for the Petitioner

Form I-360, including the Employer Attestation

1. If the petitioner has its own individual IRC 501(c)(3) letter, provide a currently valid determination letter from

the IRS establishing that the petitioning organization is a tax-exempt organization; or

2. If the petitioner is recognized as tax-exempt under a group tax exemption, provide an IRS group tax exemption

determination letter; or

3. If the petitioner is affiliated with the religious denomination, provide:

a. Currently valid determination letter from IRS;

b. Documentation that establishes the religious nature and purpose of the organization;

c. Organizational literature; and

d. Religious denomination certification.

Verifiable evidence of how the petitioner intends to compensate the beneficiary, including salaried or non-salaried

compensation. Example: Past evidence of compensation for similar positions; budgets showing monies set aside for

salaries, leases, etc.; verifiable documentation that room and board will be provided; or other evidence acceptable to

USCIS. If IRS documentation, such as IRS Form W-2 or certified tax returns, is available, it must be provided. If IRS

documentation is not available, an explanation for its absence must be provided, along with comparable, verifiable

documentation.

Requirements for the Beneficiary

Evidence of membership in a religious denomination having a bona fide non-profit religious organization in the

United States for at least 2 years immediately preceding the filing of the petition.

Evidence of prior employment: Qualifying prior continuous religious work experience during the 2 years immediately

preceding the filing of the petition must have occurred after the age of 14, and if acquired in the United States, must

have been authorized under U.S. immigration law.

1. If the beneficiary was employed in the United States during the 2 years immediately preceding the filing of the

petition and:

a. Received salaried compensation, provide IRS documentation that the beneficiary received a salary, such as

an IRS Form W-2 or certified copies of income tax returns.

b. Received non-salaried compensation, provide IRS documentation of the non-salaried compensation, if

available.

Form M-737 08/31/11 N

1

1 2

2