2002 Instructions For Form 8615

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

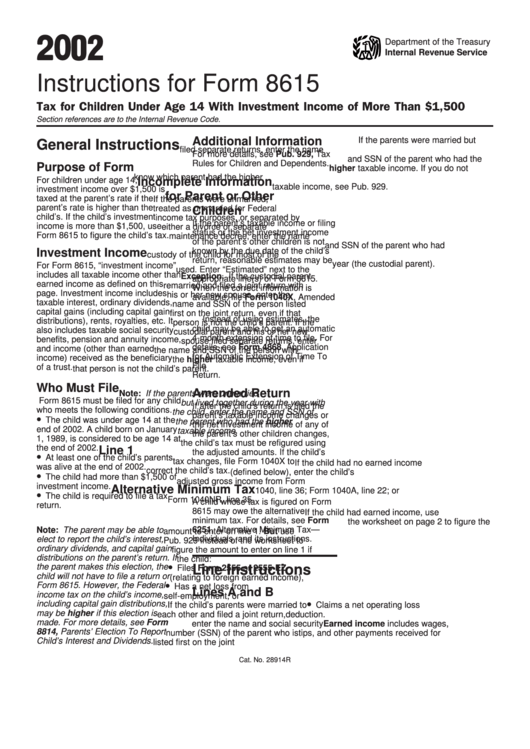

Instructions for Form 8615

Tax for Children Under Age 14 With Investment Income of More Than $1,500

Section references are to the Internal Revenue Code.

Additional Information

If the parents were married but

General Instructions

filed separate returns, enter the name

For more details, see Pub. 929, Tax

and SSN of the parent who had the

Rules for Children and Dependents.

Purpose of Form

higher taxable income. If you do not

know which parent had the higher

For children under age 14,

Incomplete Information

taxable income, see Pub. 929.

investment income over $1,500 is

for Parent or Other

taxed at the parent’s rate if the

If the parents were unmarried,

parent’s rate is higher than the

treated as unmarried for Federal

Children

child’s. If the child’s investment

income tax purposes, or separated by

If the parent’s taxable income or filing

income is more than $1,500, use

either a divorce or separate

status or the net investment income

Form 8615 to figure the child’s tax.

maintenance decree, enter the name

of the parent’s other children is not

and SSN of the parent who had

known by the due date of the child’s

Investment Income

custody of the child for most of the

return, reasonable estimates may be

year (the custodial parent).

For Form 8615, “investment income”

used. Enter “Estimated” next to the

includes all taxable income other than

Exception. If the custodial parent

appropriate line(s) of Form 8615.

earned income as defined on this

remarried and filed a joint return with

When the correct information is

page. Investment income includes

his or her new spouse, enter the

available, file Form 1040X, Amended

taxable interest, ordinary dividends,

name and SSN of the person listed

U.S. Individual Income Tax Return.

capital gains (including capital gain

first on the joint return, even if that

Instead of using estimates, the

distributions), rents, royalties, etc. It

person is not the child’s parent. If the

child may be able to get an automatic

also includes taxable social security

custodial parent and his or her new

4-month extension of time to file. For

benefits, pension and annuity income,

spouse filed separate returns, enter

details, see Form 4868, Application

and income (other than earned

the name and SSN of the person with

for Automatic Extension of Time To

income) received as the beneficiary

the higher taxable income, even if

File U.S. Individual Income Tax

of a trust.

that person is not the child’s parent.

Return.

Who Must File

Amended Return

Note: If the parents were unmarried

Form 8615 must be filed for any child

but lived together during the year with

If after the child’s return is filed the

who meets the following conditions.

the child, enter the name and SSN of

parent’s taxable income changes or

•

The child was under age 14 at the

the parent who had the higher

the net investment income of any of

end of 2002. A child born on January

taxable income.

the parent’s other children changes,

1, 1989, is considered to be age 14 at

the child’s tax must be refigured using

the end of 2002.

Line 1

the adjusted amounts. If the child’s

•

At least one of the child’s parents

tax changes, file Form 1040X to

If the child had no earned income

was alive at the end of 2002.

correct the child’s tax.

(defined below), enter the child’s

•

The child had more than $1,500 of

adjusted gross income from Form

investment income.

Alternative Minimum Tax

1040, line 36; Form 1040A, line 22; or

•

The child is required to file a tax

Form 1040NR, line 35.

A child whose tax is figured on Form

return.

8615 may owe the alternative

If the child had earned income, use

minimum tax. For details, see Form

the worksheet on page 2 to figure the

Note: The parent may be able to

6251, Alternative Minimum Tax —

amount to enter on line 1. But use

elect to report the child’s interest,

Individuals, and its instructions.

Pub. 929 instead of the worksheet to

ordinary dividends, and capital gain

figure the amount to enter on line 1 if

distributions on the parent’s return. If

the child:

•

the parent makes this election, the

Line Instructions

Files Form 2555 or 2555-EZ

child will not have to file a return or

(relating to foreign earned income),

•

Form 8615. However, the Federal

Has a net loss from

Lines A and B

income tax on the child’s income,

self-employment, or

•

including capital gain distributions,

If the child’s parents were married to

Claims a net operating loss

may be higher if this election is

each other and filed a joint return,

deduction.

made. For more details, see Form

enter the name and social security

Earned income includes wages,

8814, Parents’ Election To Report

number (SSN) of the parent who is

tips, and other payments received for

Child’s Interest and Dividends.

listed first on the joint return.

personal services performed.

Cat. No. 28914R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2