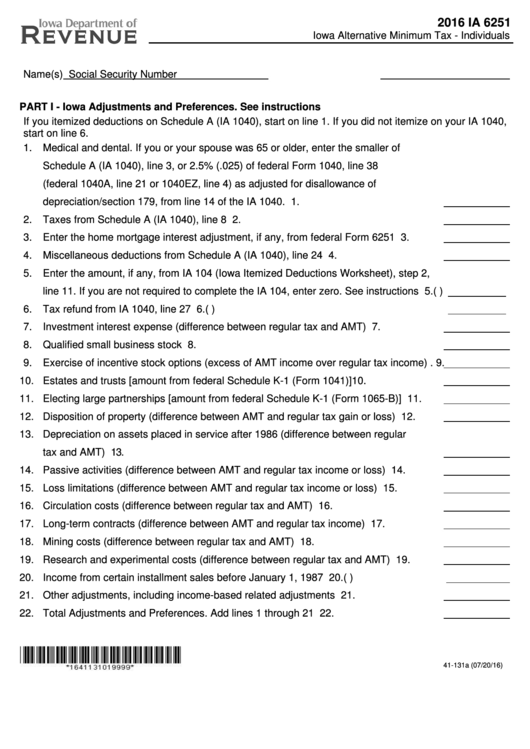

2016 IA 6251

Iowa Alternative Minimum Tax - Individuals

https://tax.iowa.gov

Name(s)

Social Security Number

PART I - Iowa Adjustments and Preferences. See instructions

If you itemized deductions on Schedule A (IA 1040), start on line 1. If you did not itemize on your IA 1040,

start on line 6.

1. Medical and dental. If you or your spouse was 65 or older, enter the smaller of

Schedule A (IA 1040), line 3, or 2.5% (.025) of federal Form 1040, line 38

(federal 1040A, line 21 or 1040EZ, line 4) as adjusted for disallowance of

depreciation/section 179, from line 14 of the IA 1040. .................................................. 1.

2. Taxes from Schedule A (IA 1040), line 8 ...................................................................... 2.

3. Enter the home mortgage interest adjustment, if any, from federal Form 6251 ............ 3.

4. Miscellaneous deductions from Schedule A (IA 1040), line 24 ..................................... 4.

5. Enter the amount, if any, from IA 104 (Iowa Itemized Deductions Worksheet), step 2,

line 11. If you are not required to complete the IA 104, enter zero. See instructions .... 5.(

)

6. Tax refund from IA 1040, line 27 ................................................................................... 6.(

)

7. Investment interest expense (difference between regular tax and AMT) ...................... 7.

8. Qualified small business stock ...................................................................................... 8.

9. Exercise of incentive stock options (excess of AMT income over regular tax income) . 9.

10. Estates and trusts [amount from federal Schedule K-1 (Form 1041)]

10.

11. Electing large partnerships [amount from federal Schedule K-1 (Form 1065-B)] ........ 11.

12. Disposition of property (difference between AMT and regular tax gain or loss) .......... 12.

13. Depreciation on assets placed in service after 1986 (difference between regular

tax and AMT) ............................................................................................................................................. 13.

14. Passive activities (difference between AMT and regular tax income or loss) .............. 14.

15. Loss limitations (difference between AMT and regular tax income or loss) ................ 15.

16. Circulation costs (difference between regular tax and AMT) ....................................... 16.

17. Long-term contracts (difference between AMT and regular tax income) ..................... 17.

18. Mining costs (difference between regular tax and AMT) ............................................. 18.

19. Research and experimental costs (difference between regular tax and AMT) ............ 19.

20. Income from certain installment sales before January 1, 1987 ................................... 20.(

)

21. Other adjustments, including income-based related adjustments ............................... 21.

22. Total Adjustments and Preferences. Add lines 1 through 21 ...................................... 22.

41-131a (07/20/16)

1

1 2

2 3

3