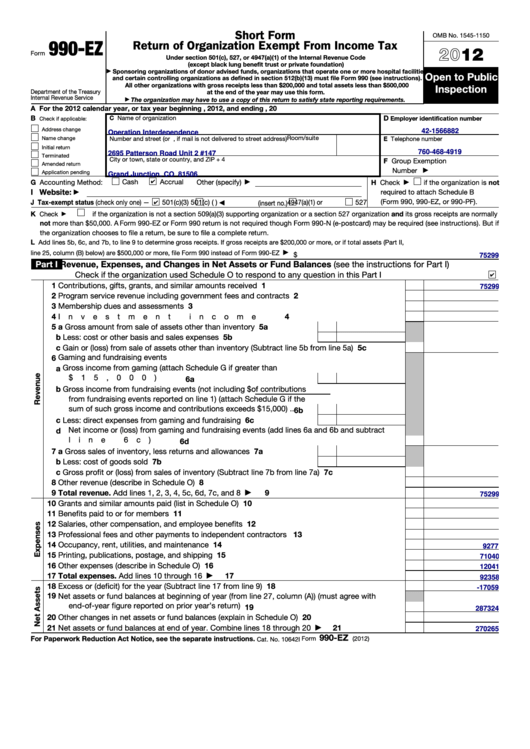

Short Form

OMB No. 1545-1150

990-EZ

Return of Organization Exempt From Income Tax

2012

Form

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

Sponsoring organizations of donor advised funds, organizations that operate one or more hospital facilities,

▶

Open to Public

and certain controlling organizations as defined in section 512(b)(13) must file Form 990 (see instructions).

All other organizations with gross receipts less than $200,000 and total assets less than $500,000

Inspection

Department of the Treasury

at the end of the year may use this form.

Internal Revenue Service

The organization may have to use a copy of this return to satisfy state reporting requirements.

▶

A For the 2012 calendar year, or tax year beginning

, 2012, and ending

, 20

B

C Name of organization

D

Employer identification number

Check if applicable:

Address change

42-1566882

Operation Interdependence

Room/suite

Name change

Number and street (or P.O. box, if mail is not delivered to street address)

E Telephone number

Initial return

760-468-4919

2695 Patterson Road Unit 2 #147

Terminated

City or town, state or country, and ZIP + 4

F Group Exemption

Amended return

Number

▶

Application pending

Grand Junction, CO 81506

Cash

Accrual

G Accounting Method:

Other (specify)

H Check

if the organization is not

▶

▶

I Website:

required to attach Schedule B

▶

J Tax-exempt status (check only one) —

(Form 990, 990-EZ, or 990-PF).

501(c)(3)

501(c) (

)

4947(a)(1) or

527

(insert no.)

◀

K

if the organization is not a section 509(a)(3) supporting organization or a section 527 organization and its gross receipts are normally

Check

▶

not more than $50,000. A Form 990-EZ or Form 990 return is not required though Form 990-N (e-postcard) may be required (see instructions). But if

the organization chooses to file a return, be sure to file a complete return.

L

Add lines 5b, 6c, and 7b, to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets (Part II,

line 25, column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ

.

.

.

.

.

.

.

.

.

.

▶

$

75299

Part I

Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I)

Check if the organization used Schedule O to respond to any question in this Part I . . . . . . . . . .

1

1

Contributions, gifts, grants, and similar amounts received .

.

.

.

.

.

.

.

.

.

.

.

.

75299

2

2

Program service revenue including government fees and contracts

.

.

.

.

.

.

.

.

.

3

Membership dues and assessments .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Investment income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5 a Gross amount from sale of assets other than inventory

5a

.

.

.

.

b Less: cost or other basis and sales expenses .

.

.

.

.

.

.

.

5b

c Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a) .

.

.

.

5c

Gaming and fundraising events

6

a Gross income from gaming (attach Schedule G if greater than

$15,000) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Gross income from fundraising events (not including $

of contributions

from fundraising events reported on line 1) (attach Schedule G if the

sum of such gross income and contributions exceeds $15,000) .

.

6b

c Less: direct expenses from gaming and fundraising events

.

.

.

6c

d Net income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract

line 6c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6d

7 a Gross sales of inventory, less returns and allowances .

.

.

.

.

7a

b Less: cost of goods sold

7b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a) .

.

.

.

.

.

.

7c

8

Other revenue (describe in Schedule O) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8

9

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

75299

10

Grants and similar amounts paid (list in Schedule O)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Benefits paid to or for members .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

12

Salaries, other compensation, and employee benefits .

.

.

.

.

.

.

.

.

.

.

.

.

.

13

13

Professional fees and other payments to independent contractors .

.

.

.

.

.

.

.

.

.

14

Occupancy, rent, utilities, and maintenance

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

9277

15

Printing, publications, postage, and shipping .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

71040

16

16

Other expenses (describe in Schedule O) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12041

17

Total expenses. Add lines 10 through 16 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

▶

92358

18

Excess or (deficit) for the year (Subtract line 17 from line 9)

.

.

.

.

.

.

.

.

.

.

.

.

18

-17059

19

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with

end-of-year figure reported on prior year’s return)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

287324

20

Other changes in net assets or fund balances (explain in Schedule O) .

.

.

.

.

.

.

.

.

20

21

21

Net assets or fund balances at end of year. Combine lines 18 through 20

.

.

.

.

.

.

▶

270265

990-EZ

For Paperwork Reduction Act Notice, see the separate instructions.

Form

(2012)

Cat. No. 10642I

1

1 2

2 3

3 4

4