Form 8233 - Ucla Department Of Bioengineering Page 2

ADVERTISEMENT

2

Form 8233 (Rev. 12-2001)

Page

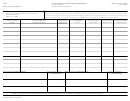

Part II

Claim for Tax Treaty Withholding Exemption and/or Personal Exemption Amount

11

Compensation for independent (and certain dependent) personal services:

a

Description of personal services you are providing

b

Total compensation you expect to be paid for these services in this calendar or tax year

$

12

If compensation is exempt from withholding based on a tax treaty benefit, provide:

a Tax treaty and treaty article on which you are basing exemption from withholding

b Total compensation listed on line 11b above that is exempt from tax under this treaty

$

c

Country of permanent residence

Note: Do not complete lines 13a through 13c unless you also received compensation for personal services from the same

withholding agent.

13

Noncompensatory scholarship or fellowship income:

a

Amount $

b Tax treaty and treaty article on which you are basing exemption from withholding

c Total income listed on line 13a above that is exempt from tax under this treaty $

14

Sufficient facts to justify the exemption from withholding claimed on line 12 and/or line 13 (see instructions)

Note: Lines 15 through 18 are to be completed only for certain independent personal services (see instructions).

16

15

Number of personal exemptions

How many days will you perform services in

claimed

the United States during this tax year?

17

Daily personal exemption amount claimed (see instructions)

18

Total personal exemption amount claimed. Multiply line 16 by line 17

Part III

Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete.

I further certify under penalties of perjury that:

● I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates.

● The beneficial owner is not a U.S. person.

● The beneficial owner is a resident of the treaty country listed on line 12a and/or 13b above within the meaning of the income tax treaty between the United States

and that country.

● The beneficial owner is not a former citizen or long-term resident of the United States subject to section 877 (relating to certain acts of expatriation) or, if subject

to section 877, the beneficial owner is nevertheless entitled to treaty benefits with respect to the amounts received.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or

any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.

Sign Here

Signature of beneficial owner (or individual authorized to sign for beneficial owner)

Date

Withholding Agent Acceptance and Certification

Part IV

Employer identification number

Name

The Regents of the University of California, Los Angeles

95-6006143

Address (number and street) (Include apt. or suite no. or P.O. box, if applicable.)

10920 Wilshire Blvd, Suite 620

City, state, and ZIP code

Telephone number

Los Angeles, CA 90024

(310) 794-8718

Under penalties of perjury, I certify that I have examined this form and any accompanying statements, that I am satisfied that an exemption from withholding is warranted,

and that I do not know or have reason to know that the nonresident alien individual is not entitled to the exemption or that the nonresident alien’s eligibility for the

exemption cannot be readily determined.

Date

Signature of withholding agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2