Form 8233 - Ucla Department Of Bioengineering

ADVERTISEMENT

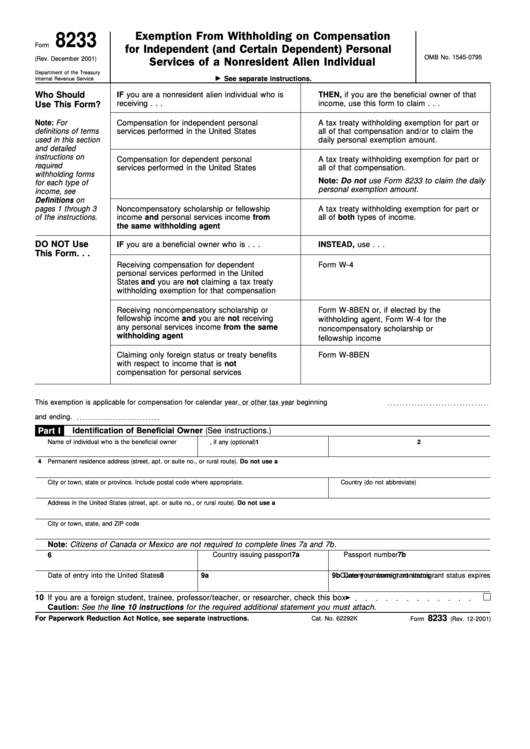

8233

Exemption From Withholding on Compensation

Form

for Independent (and Certain Dependent) Personal

OMB No. 1545-0795

(Rev. December 2001)

Services of a Nonresident Alien Individual

Department of the Treasury

See separate instructions.

Internal Revenue Service

Who Should

IF you are a nonresident alien individual who is

THEN, if you are the beneficial owner of that

receiving . . .

income, use this form to claim . . .

Use This Form?

Note: For

Compensation for independent personal

A tax treaty withholding exemption for part or

services performed in the United States

all of that compensation and/or to claim the

definitions of terms

used in this section

daily personal exemption amount.

and detailed

instructions on

Compensation for dependent personal

A tax treaty withholding exemption for part or

required

services performed in the United States

all of that compensation.

withholding forms

Note: Do not use Form 8233 to claim the daily

for each type of

personal exemption amount.

income, see

Definitions on

pages 1 through 3

Noncompensatory scholarship or fellowship

A tax treaty withholding exemption for part or

of the instructions.

income and personal services income from

all of both types of income.

the same withholding agent

DO NOT Use

IF you are a beneficial owner who is . . .

INSTEAD, use . . .

This Form. . .

Receiving compensation for dependent

Form W-4

personal services performed in the United

States and you are not claiming a tax treaty

withholding exemption for that compensation

Receiving noncompensatory scholarship or

Form W-8BEN or, if elected by the

fellowship income and you are not receiving

withholding agent, Form W-4 for the

any personal services income from the same

noncompensatory scholarship or

withholding agent

fellowship income

Claiming only foreign status or treaty benefits

Form W-8BEN

with respect to income that is not

compensation for personal services

This exemption is applicable for compensation for calendar year

, or other tax year beginning

and ending

.

Part I

Identification of Beneficial Owner (See instructions.)

1

Name of individual who is the beneficial owner

2

U.S. taxpayer identifying number

3

Foreign tax identifying number, if any (optional)

4

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box.

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

5

Address in the United States (street, apt. or suite no., or rural route). Do not use a P.O. box.

City or town, state, and ZIP code

Note: Citizens of Canada or Mexico are not required to complete lines 7a and 7b.

6

U.S. visa type

7a

Country issuing passport

7b

Passport number

8

Date of entry into the United States

9a

Current nonimmigrant status

9b

Date your current nonimmigrant status expires

10

If you are a foreign student, trainee, professor/teacher, or researcher, check this box

Caution: See the line 10 instructions for the required additional statement you must attach.

8233

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 62292K

Form

(Rev. 12-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2