(Eic) Alternate Eligibility Record (Due Diligence)

ADVERTISEMENT

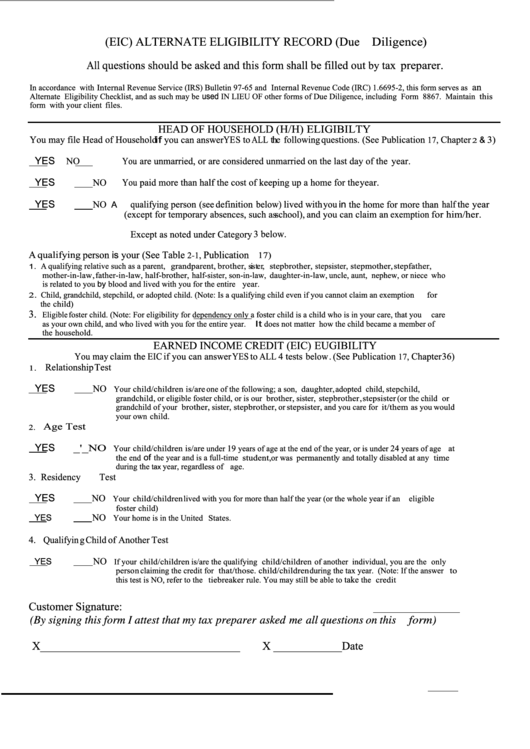

(EIC) ALTERNATE ELIGIBILITY RECORD (Due Diligence)

All questions should be asked and this form shall be filled out by tax preparer.

an

In accordance with Internal Revenue Service (IRS) Bulletin 97-65 and Internal Revenue Code (IRC) 1.6695-2, this form serves as

used

Alternate Eligibility Checklist, and as such may be

IN LIEU OF other forms of Due Diligence, including Form 8867. Maintain this

form with your client files.

HEAD OF HOUSEHOLD (H/H) ELIGIBILTY

You may file Head of Household if you can answer YES to ALL the following questions. (See Publication

Chapter

3)

17,

&

2

YES

NO

You are unmarried, or are considered unmarried on the last day of the year.

YES

NO

You paid more than half the cost of keeping up a home for the year.

YES

NO

qualifying person (see definition below) lived with you in the home for more than half the year

A

(except for temporary absences, such as school), and you can claim an exemption for him/her.

Except as noted under Category 3 below.

A qualifying person is your (See Table

Publication

2-1,

17)

A qualifying relative such as a parent, grandparent, brother, sister, stepbrother, stepsister, stepmother, stepfather,

1.

mother-in-law, father-in-law, half-brother, half-sister, son-in-law, daughter-in-law, uncle, aunt, nephew, or niece who

is related to you by blood and lived with you for the entire year.

Child, grandchild, stepchild, or adopted child. (Note: Is a qualifying child even if you cannot claim an exemption for

2.

the child)

3.

Eligible foster child. (Note: For eligibility for dependency only a foster child is a child who is in your care, that you care

as your own child, and who lived with you for the entire year. It does not matter how the child became a member of

the household.

EARNED INCOME CREDIT (EIC) EUGIBILITY

You may claim the EIC if you can answer YES to ALL 4 tests below. (See Publication

Chapter 36)

17,

Relationship Test

1.

YES

NO

Your child/children is/are one of the following; a son, daughter, adopted child, stepchild,

grandchild, or eligible foster child, or is our brother, sister, stepbrother, stepsister (or the child or

grandchild of your brother, sister, stepbrother, or stepsister, and you care for it/them as you would

your own child.

Age Test

2.

YES _'_NO

19

24

Your child/children is/are under

years of age at the end of the year, or is under

years of age at

of

the end

the year and is a full-time student, or was permanently and totally disabled at any time

during the

year, regardless of age.

tax

3. R e s i d e n c y Test

YES

NO

Your child/children lived with you for more than half the year (or the whole year if an eligible

foster child)

NO

YES

Your home is in the United States.

4. Qualifying Child of Another Test

NO

YES

If your child/children is/are the qualifying child/children of another individual, you are the only

person claiming the credit for that/those. child/children during the tax year. (Note: If the answer to

take

this test is NO, refer to the tiebreaker rule. You may still be able to

the credit

Customer Signature:

(By signing this form I attest that my tax preparer asked me all questions on this form)

X___________________________________

X ____________Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2