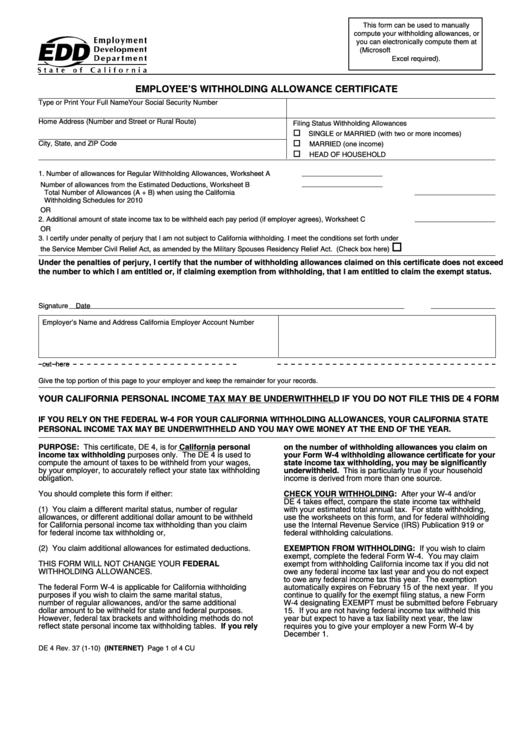

This form can be used to manually

compute your withholding allowances, or

you can electronically compute them at

(Microsoft

Excel required).

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Type or Print Your Full Name

Your Social Security Number

Home Address (Number and Street or Rural Route)

Filing Status Withholding Allowances

SINGLE or MARRIED (with two or more incomes)

City, State, and ZIP Code

MARRIED (one income)

HEAD OF HOUSEHOLD

1. Number of allowances for Regular Withholding Allowances, Worksheet A

Number of allowances from the Estimated Deductions, Worksheet B

Total Number of Allowances (A + B) when using the California

Withholding Schedules for 2010

OR

2. Additional amount of state income tax to be withheld each pay period (if employer agrees), Worksheet C

OR

3. I certify under penalty of perjury that I am not subject to California withholding. I meet the conditions set forth under

the Service Member Civil Relief Act, as amended by the Military Spouses Residency Relief Act.

(Check box here)

Under the penalties of perjury, I certify that the number of withholding allowances claimed on this certificate does not exceed

the number to which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status.

Signature

Date

Employer’s Name and Address

California Employer Account Number

cut here

Give the top portion of this page to your employer and keep the remainder for your records.

YOUR CALIFORNIA PERSONAL INCOME TAX MAY BE UNDERWITHHELD IF YOU DO NOT FILE THIS DE 4 FORM

IF YOU RELY ON THE FEDERAL W-4 FOR YOUR CALIFORNIA WITHHOLDING ALLOWANCES, YOUR CALIFORNIA STATE

PERSONAL INCOME TAX MAY BE UNDERWITHHELD AND YOU MAY OWE MONEY AT THE END OF THE YEAR.

PURPOSE: This certificate, DE 4, is for California personal

on the number of withholding allowances you claim on

income tax withholding purposes only. The DE 4 is used to

your Form W-4 withholding allowance certificate for your

state income tax withholding, you may be significantly

compute the amount of taxes to be withheld from your wages,

by your employer, to accurately reflect your state tax withholding

underwithheld. This is particularly true if your household

obligation.

income is derived from more than one source.

You should complete this form if either:

CHECK YOUR WITHHOLDING: After your W-4 and/or

DE 4 takes effect, compare the state income tax withheld

(1) You claim a different marital status, number of regular

with your estimated total annual tax. For state withholding,

allowances, or different additional dollar amount to be withheld

use the worksheets on this form, and for federal withholding

for California personal income tax withholding than you claim

use the Internal Revenue Service (IRS) Publication 919 or

for federal income tax withholding or,

federal withholding calculations.

(2) You claim additional allowances for estimated deductions.

EXEMPTION FROM WITHHOLDING: If you wish to claim

exempt, complete the federal Form W-4. You may claim

THIS FORM WILL NOT CHANGE YOUR FEDERAL

exempt from withholding California income tax if you did not

WITHHOLDING ALLOWANCES.

owe any federal income tax last year and you do not expect

to owe any federal income tax this year. The exemption

The federal Form W-4 is applicable for California withholding

automatically expires on February 15 of the next year. If you

purposes if you wish to claim the same marital status,

continue to qualify for the exempt filing status, a new Form

number of regular allowances, and/or the same additional

W-4 designating EXEMPT must be submitted before February

dollar amount to be withheld for state and federal purposes.

15. If you are not having federal income tax withheld this

However, federal tax brackets and withholding methods do not

year but expect to have a tax liability next year, the law

reflect state personal income tax withholding tables. If you rely

requires you to give your employer a new Form W-4 by

December 1.

DE 4 Rev. 37 (1-10) (INTERNET)

Page 1 of 4

CU

1

1 2

2 3

3 4

4