Request For Income Tax Withholding - Arlingtonva

ADVERTISEMENT

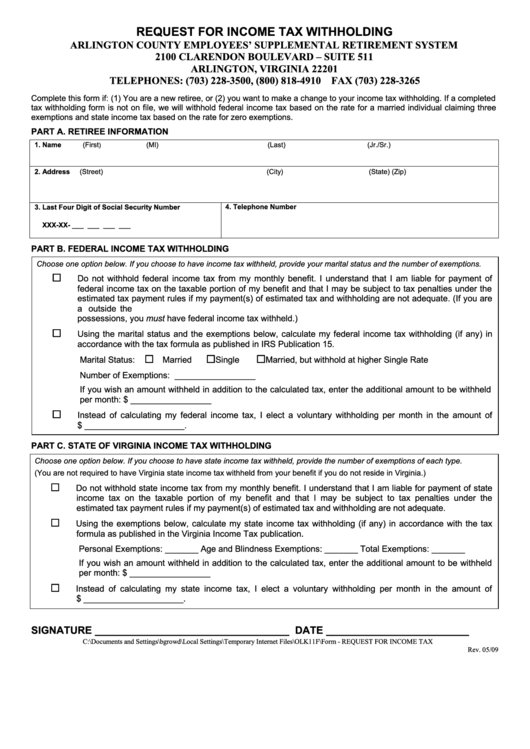

REQUEST FOR INCOME TAX WITHHOLDING

ARLINGTON COUNTY EMPLOYEES’ SUPPLEMENTAL RETIREMENT SYSTEM

2100 CLARENDON BOULEVARD – SUITE 511

ARLINGTON, VIRGINIA 22201

TELEPHONES: (703) 228-3500, (800) 818-4910 FAX (703) 228-3265

Complete this form if: (1) You are a new retiree, or (2) you want to make a change to your income tax withholding. If a completed

tax withholding form is not on file, we will withhold federal income tax based on the rate for a married individual claiming three

exemptions and state income tax based on the rate for zero exemptions.

PART A. RETIREE INFORMATION

1. Name

(First

(MI)

(Last)

(Jr./Sr.)

)

2. Address

(Street)

(City)

(State) (Zip)

3. Last Four Digit of Social Security Number

4. Telephone Number

XXX-XX- ___ ___ ___ ___

PART B. FEDERAL INCOME TAX WITHHOLDING

Choose one option below. If you choose to have income tax withheld, provide your marital status and the number of exemptions.

Do not withhold federal income tax from my monthly benefit. I understand that I am liable for payment of

federal income tax on the taxable portion of my benefit and that I may be subject to tax penalties under the

estimated tax payment rules if my payment(s) of estimated tax and withholding are not adequate. (If you are

a U.S. Citizen or resident alien and your monthly benefit payments are delivered outside the U.S. or its

possessions, you must have federal income tax withheld.)

Using the marital status and the exemptions below, calculate my federal income tax withholding (if any) in

accordance with the tax formula as published in IRS Publication 15.

Marital Status:

Married

Single

Married, but withhold at higher Single Rate

Number of Exemptions: _________________

If you wish an amount withheld in addition to the calculated tax, enter the additional amount to be withheld

per month: $ _________________

Instead of calculating my federal income tax, I elect a voluntary withholding per month in the amount of

$ _____________________.

PART C. STATE OF VIRGINIA INCOME TAX WITHHOLDING

Choose one option below. If you choose to have state income tax withheld, provide the number of exemptions of each type.

(You are not required to have Virginia state income tax withheld from your benefit if you do not reside in Virginia.)

Do not withhold state income tax from my monthly benefit. I understand that I am liable for payment of state

income tax on the taxable portion of my benefit and that I may be subject to tax penalties under the

estimated tax payment rules if my payment(s) of estimated tax and withholding are not adequate.

Using the exemptions below, calculate my state income tax withholding (if any) in accordance with the tax

formula as published in the Virginia Income Tax publication.

Personal Exemptions: _______ Age and Blindness Exemptions: _______ Total Exemptions: _______

If you wish an amount withheld in addition to the calculated tax, enter the additional amount to be withheld

per month: $ _________________

Instead of calculating my state income tax, I elect a voluntary withholding per month in the amount of

$ _____________________.

SIGNATURE __________________________________ DATE _________________________

C:\Documents and Settings\bgrowd\Local Settings\Temporary Internet Files\OLK11F\Form - REQUEST FOR INCOME TAX WITHHOLDING.doc

Rev. 05/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2