Print

Reset

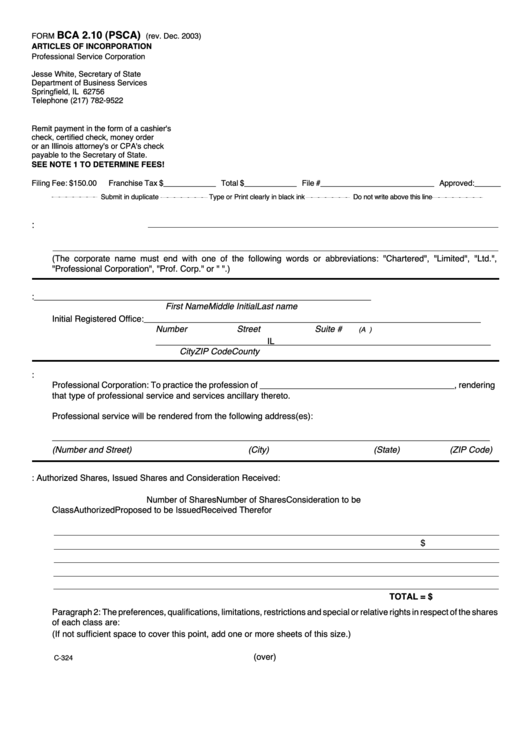

BCA 2.10 (PSCA)

FORM

(rev. Dec. 2003)

ARTICLES OF INCORPORATION

Professional Service Corporation

Jesse White, Secretary of State

Department of Business Services

Springfield, IL 62756

Telephone (217) 782-9522

Remit payment in the form of a cashier's

check, certified check, money order

or an Illinois attorney's or CPA's check

payable to the Secretary of State.

SEE NOTE 1 TO DETERMINE FEES!

Filing Fee: $150.00

Franchise Tax $____________ Total $____________ File #__________________________ Approved:______

——————————Submit in duplicate ———————Type or Print clearly in black ink———————Do not write above this

line——————————

1.

CORPORATE NAME:

__________________________________________________________________

____________________________________________________________________________________

(The corporate name must end with one of the following words or abbreviations: "Chartered", "Limited", "Ltd.",

"Professional Corporation", "Prof. Corp." or "P.C.".)

2.

Initial Registered Agent:

_______________________________________________________________________

First Name

Middle Initial

Last name

Initial Registered Office:

_______________________________________________________________________

Number

Street

Suite #

(A P.O. BOX ALONE IS NOT ACCEPTABLE)

________________________________________________________________

IL

City

ZIP Code

County

3.

Purpose or purposes for which the corporation is organized:

Professional Corporation: To practice the profession of _________________________________________, rendering

that type of professional service and services ancillary thereto.

Professional service will be rendered from the following address(es):

_____________________________________________________________________________________________

(Number and Street)

(City)

(State)

(ZIP Code)

4.

Paragraph 1: Authorized Shares, Issued Shares and Consideration Received:

Number of Shares

Number of Shares

Consideration to be

Class

Authorized

Proposed to be Issued

Received Therefor

$

TOTAL = $

Paragraph 2: The preferences, qualifications, limitations, restrictions and special or relative rights in respect of the shares

of each class are:

(If not sufficient space to cover this point, add one or more sheets of this size.)

(over)

C-324

1

1 2

2