Parent'S Election To Report Child'S Interest And Dividends Form 8814 (1991)

ADVERTISEMENT

8814

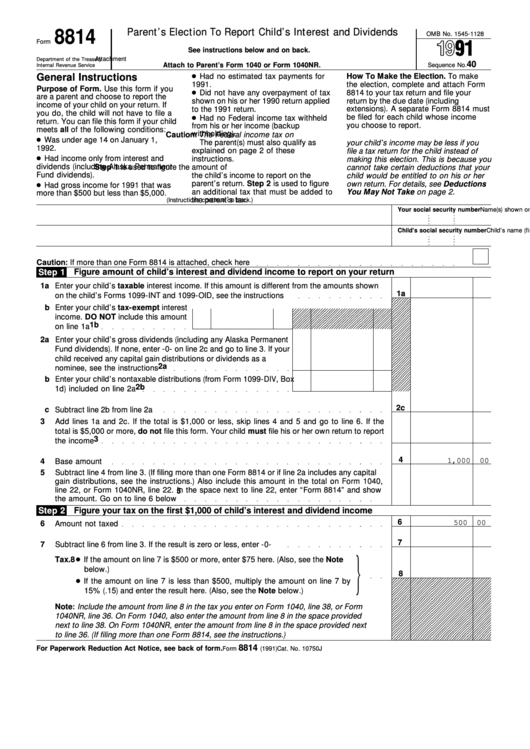

Parent’s Election To Report Child’s Interest and Dividends

OMB No. 1545-1128

Form

See instructions below and on back.

Attachment

Department of the Treasury

40

Attach to Parent’s Form 1040 or Form 1040NR.

Sequence No.

Internal Revenue Service

General Instructions

Had no estimated tax payments for

How To Make the Election. To make

1991.

the election, complete and attach Form

Purpose of Form. Use this form if you

Did not have any overpayment of tax

8814 to your tax return and file your

are a parent and choose to report the

shown on his or her 1990 return applied

return by the due date (including

income of your child on your return. If

to the 1991 return.

extensions). A separate Form 8814 must

you do, the child will not have to file a

be filed for each child whose income

Had no Federal income tax withheld

return. You can file this form if your child

you choose to report.

from his or her income (backup

meets all of the following conditions:

withholding).

Caution: The Federal income tax on

Was under age 14 on January 1,

The parent(s) must also qualify as

your child’s income may be less if you

1992.

explained on page 2 of these

file a tax return for the child instead of

Had income only from interest and

instructions.

making this election. This is because you

dividends (including Alaska Permanent

Step 1 is used to figure the amount of

cannot take certain deductions that your

Fund dividends).

the child’s income to report on the

child would be entitled to on his or her

parent’s return. Step 2 is used to figure

own return. For details, see Deductions

Had gross income for 1991 that was

an additional tax that must be added to

You May Not Take on page 2.

more than $500 but less than $5,000.

the parent’s tax.

(Instructions continue on back.)

Name(s) shown on parent’s return

Your social security number

Child’s name (first, initial, and last)

Child’s social security number

Caution: If more than one Form 8814 is attached, check here

Figure amount of child’s interest and dividend income to report on your return

Step 1

1a

Enter your child’s taxable interest income. If this amount is different from the amounts shown

1a

on the child’s Forms 1099-INT and 1099-OID, see the instructions

b Enter your child’s tax-exempt interest

income. DO NOT include this amount

1b

on line 1a

2a Enter your child’s gross dividends (including any Alaska Permanent

Fund dividends). If none, enter -0- on line 2c and go to line 3. If your

child received any capital gain distributions or dividends as a

2a

nominee, see the instructions

b Enter your child’s nontaxable distributions (from Form 1099-DIV, Box

2b

1d) included on line 2a

2c

c

Subtract line 2b from line 2a

3

Add lines 1a and 2c. If the total is $1,000 or less, skip lines 4 and 5 and go to line 6. If the

total is $5,000 or more, do not file this form. Your child must file his or her own return to report

3

the income

4

4

Base amount

1,000

00

5

Subtract line 4 from line 3. (If filing more than one Form 8814 or if line 2a includes any capital

gain distributions, see the instructions.) Also include this amount in the total on Form 1040,

line 22, or Form 1040NR, line 22. In the space next to line 22, enter “Form 8814” and show

5

the amount. Go on to line 6 below

Figure your tax on the first $1,000 of child’s interest and dividend income

Step 2

6

500

00

6

Amount not taxed

7

7

Subtract line 6 from line 3. If the result is zero or less, enter -0-

8

Tax.

If the amount on line 7 is $500 or more, enter $75 here. (Also, see the Note

below.)

8

If the amount on line 7 is less than $500, multiply the amount on line 7 by

15% (.15) and enter the result here. (Also, see the Note below.)

Note: Include the amount from line 8 in the tax you enter on Form 1040, line 38, or Form

1040NR, line 36. On Form 1040, also enter the amount from line 8 in the space provided

next to line 38. On Form 1040NR, enter the amount from line 8 in the space provided next

to line 36. (If filing more than one Form 8814, see the instructions.)

8814

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 10750J

Form

(1991)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2