Tax For Children Under Age 14 (Form 8615 1994)

ADVERTISEMENT

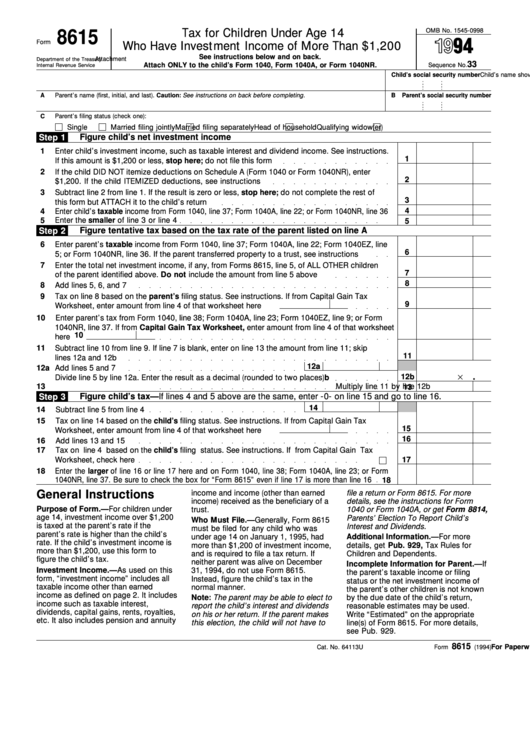

8615

OMB No. 1545-0998

Tax for Children Under Age 14

Form

Who Have Investment Income of More Than $1,200

See instructions below and on back.

Attachment

Department of the Treasury

33

Attach ONLY to the child’s Form 1040, Form 1040A, or Form 1040NR.

Sequence No.

Internal Revenue Service

Child’s name shown on return

Child’s social security number

A

Parent’s name (first, initial, and last). Caution: See instructions on back before completing.

B

Parent’s social security number

C

Parent’s filing status (check one):

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er)

Step 1

Figure child’s net investment income

1

Enter child’s investment income, such as taxable interest and dividend income. See instructions.

1

If this amount is $1,200 or less, stop here; do not file this form

2

If the child DID NOT itemize deductions on Schedule A (Form 1040 or Form 1040NR), enter

2

$1,200. If the child ITEMIZED deductions, see instructions

3

Subtract line 2 from line 1. If the result is zero or less, stop here; do not complete the rest of

3

this form but ATTACH it to the child’s return

4

4

Enter child’s taxable income from Form 1040, line 37; Form 1040A, line 22; or Form 1040NR, line 36

5

Enter the smaller of line 3 or line 4

5

Figure tentative tax based on the tax rate of the parent listed on line A

Step 2

6

Enter parent’s taxable income from Form 1040, line 37; Form 1040A, line 22; Form 1040EZ, line

6

5; or Form 1040NR, line 36. If the parent transferred property to a trust, see instructions

7

Enter the total net investment income, if any, from Forms 8615, line 5, of ALL OTHER children

7

of the parent identified above. Do not include the amount from line 5 above

8

8

Add lines 5, 6, and 7

9

Tax on line 8 based on the parent’s filing status. See instructions. If from Capital Gain Tax

9

Worksheet, enter amount from line 4 of that worksheet here

10

Enter parent’s tax from Form 1040, line 38; Form 1040A, line 23; Form 1040EZ, line 9; or Form

1040NR, line 37. If from Capital Gain Tax Worksheet, enter amount from line 4 of that worksheet

10

here

11

Subtract line 10 from line 9. If line 7 is blank, enter on line 13 the amount from line 11; skip

11

lines 12a and 12b

12a

12a

Add lines 5 and 7

.

12b

b

Divide line 5 by line 12a. Enter the result as a decimal (rounded to two places)

13

Multiply line 11 by line 12b

13

Figure child’s tax—If lines 4 and 5 above are the same, enter -0- on line 15 and go to line 16.

Step 3

14

14

Subtract line 5 from line 4

15

Tax on line 14 based on the child’s filing status. See instructions. If from Capital Gain Tax

15

Worksheet, enter amount from line 4 of that worksheet here

16

16

Add lines 13 and 15

17

Tax on line 4 based on the child’s filing status. See instructions. If from Capital Gain Tax

Worksheet, check here

17

18

Enter the larger of line 16 or line 17 here and on Form 1040, line 38; Form 1040A, line 23; or Form

1040NR, line 37. Be sure to check the box for “Form 8615” even if line 17 is more than line 16

18

General Instructions

income and income (other than earned

file a retur n or For m 8615. For more

income) received as the beneficiary of a

details, see the instructions for Form

Purpose of Form.—For children under

trust.

1040 or Form 1040A, or get Form 8814,

age 14, investment income over $1,200

Parents’ Election To Report Child’s

Who Must File.—Generally, Form 8615

is taxed at the parent’s rate if the

Interest and Dividends.

must be filed for any child who was

parent’s rate is higher than the child’s

under age 14 on January 1, 1995, had

Additional Information.—For more

rate. If the child’s investment income is

more than $1,200 of investment income,

details, get Pub. 929, Tax Rules for

more than $1,200, use this form to

and is required to file a tax return. If

Children and Dependents.

figure the child’s tax.

neither parent was alive on December

Incomplete Information for Parent.—If

Investment Income.—As used on this

31, 1994, do not use Form 8615.

the parent’s taxable income or filing

form, “investment income” includes all

Instead, figure the child’s tax in the

status or the net investment income of

taxable income other than earned

normal manner.

the parent’s other children is not known

income as defined on page 2. It includes

Note: The parent may be able to elect to

by the due date of the child’s return,

income such as taxable interest,

report the child’s interest and dividends

reasonable estimates may be used.

dividends, capital gains, rents, royalties,

on his or her retur n. If the parent makes

Write “Estimated” on the appropriate

etc. It also includes pension and annuity

this election, the child will not have to

line(s) of Form 8615. For more details,

see Pub. 929.

8615

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 64113U

Form

(1994)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2