Power Of Attorney And Declaration Of Representative

ADVERTISEMENT

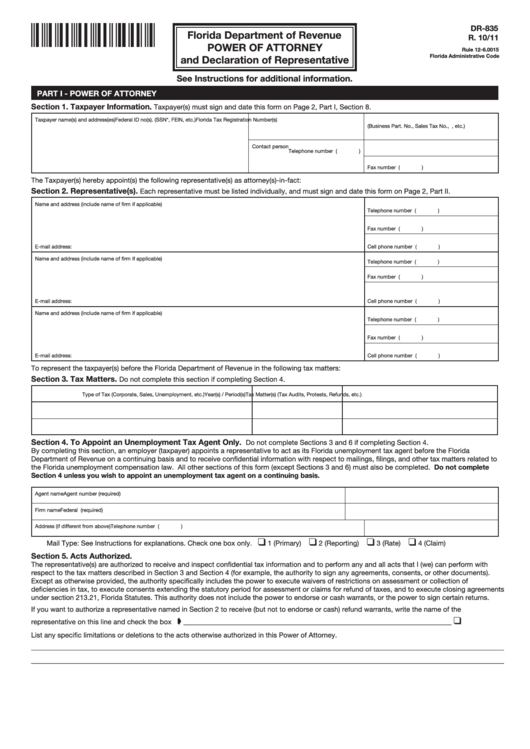

DR-835

Florida Department of Revenue

R. 10/11

POWER OF ATTORNEY

Rule 12-6.0015

Florida Administrative Code

and Declaration of Representative

See Instructions for additional information.

PART I - POWER OF ATTORNEY

Section 1.

Taxpayer Information.

Taxpayer(s) must sign and date this form on Page 2, Part I, Section 8.

Taxpayer name(s) and address(es)

Federal ID no(s). (SSN*, FEIN, etc.)

Florida Tax Registration Number(s)

(Business Part. No., Sales Tax No., U.T. Acct No., etc.)

Contact person

Telephone number (

)

Fax number (

)

The Taxpayer(s) hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

Section 2.

Representative(s).

Each representative must be listed individually, and must sign and date this form on Page 2, Part II.

Name and address (include name of firm if applicable)

Telephone number (

)

Fax number (

)

E-mail address:

Cell phone number (

)

Name and address (include name of firm if applicable)

Telephone number (

)

Fax number (

)

E-mail address:

Cell phone number (

)

Name and address (include name of firm if applicable)

Telephone number (

)

Fax number (

)

E-mail address:

Cell phone number (

)

To represent the taxpayer(s) before the Florida Department of Revenue in the following tax matters:

Section 3.

Tax Matters.

Do not complete this section if completing Section 4.

Type of Tax (Corporate, Sales, Unemployment, etc.)

Year(s) / Period(s)

Tax Matter(s) (Tax Audits, Protests, Refunds, etc.)

Section 4.

To Appoint an Unemployment Tax Agent Only.

Do not complete Sections 3 and 6 if completing Section 4.

By completing this section, an employer (taxpayer) appoints a representative to act as its Florida unemployment tax agent before the Florida

Department of Revenue on a continuing basis and to receive confidential information with respect to mailings, filings, and other tax matters related to

the Florida unemployment compensation law. All other sections of this form (except Sections 3 and 6) must also be completed. Do not complete

Section 4 unless you wish to appoint an unemployment tax agent on a continuing basis.

Agent name

Agent number (required)

Firm name

Federal I.D. No. (required)

Address (if different from above)

Telephone number (

)

❑

❑

❑

❑

Mail Type: See Instructions for explanations. Check one box only.

1 (Primary)

2 (Reporting)

3 (Rate)

4 (Claim)

Section 5.

Acts Authorized.

The representative(s) are authorized to receive and inspect confidential tax information and to perform any and all acts that I (we) can perform with

respect to the tax matters described in Section 3 and Section 4 (for example, the authority to sign any agreements, consents, or other documents).

Except as otherwise provided, the authority specifically includes the power to execute waivers of restrictions on assessment or collection of

deficiencies in tax, to execute consents extending the statutory period for assessment or claims for refund of taxes, and to execute closing agreements

under section 213.21, Florida Statutes. This authority does not include the power to endorse or cash warrants, or the power to sign certain returns.

If you want to authorize a representative named in Section 2 to receive (but not to endorse or cash) refund warrants, write the name of the

❑

➧

representative on this line and check the box ........................

____________________________________________________________________________

List any specific limitations or deletions to the acts otherwise authorized in this Power of Attorney.

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4