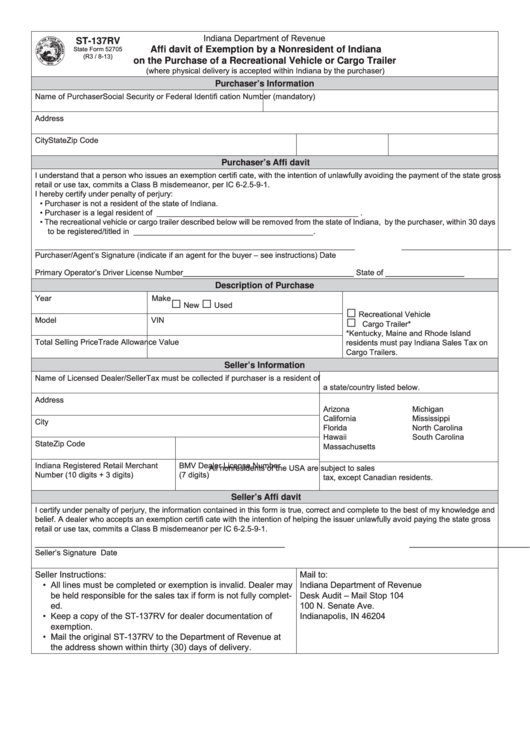

Indiana Department of Revenue

ST-137RV

State Form 52705

Affi davit of Exemption by a Nonresident of Indiana

(R3 / 8-13)

on the Purchase of a Recreational Vehicle or Cargo Trailer

(where physical delivery is accepted within Indiana by the purchaser)

Purchaser’s Information

Name of Purchaser

Social Security or Federal Identifi cation Number (mandatory)

Address

City

State

Zip Code

Purchaser’s Affi davit

I understand that a person who issues an exemption certifi cate, with the intention of unlawfully avoiding the payment of the state gross

retail or use tax, commits a Class B misdemeanor, per IC 6-2.5-9-1.

I hereby certify under penalty of perjury:

• Purchaser is not a resident of the state of Indiana.

• Purchaser is a legal resident of ______________________________________________ .

• The recreational vehicle or cargo trailer described below will be removed from the state of Indiana, by the purchaser, within 30 days

to be registered/titled in _________________________________________ .

_________________________________________________________________________

_________________________

Purchaser/Agent’s Signature (indicate if an agent for the buyer – see instructions)

Date

Primary Operator’s Driver License Number_______________________________________

State of __________________

Description of Purchase

□

□

Year

Make

□

New

Used

□

Recreational Vehicle

Model

VIN

Cargo Trailer*

*Kentucky, Maine and Rhode Island

Total Selling Price

Trade Allowance Value

residents must pay Indiana Sales Tax on

Cargo Trailers.

Seller’s Information

Name of Licensed Dealer/Seller

Tax must be collected if purchaser is a resident of

a state/country listed below.

Address

Arizona

Michigan

California

Mississippi

City

Florida

North Carolina

Hawaii

South Carolina

State

Zip Code

Massachusetts

Indiana Registered Retail Merchant

BMV Dealer License Number

All nonresidents of the USA are subject to sales

Number (10 digits + 3 digits)

(7 digits)

tax, except Canadian residents.

Seller’s Affi davit

I certify under penalty of perjury, the information contained in this form is true, correct and complete to the best of my knowledge and

belief. A dealer who accepts an exemption certifi cate with the intention of helping the issuer unlawfully avoid paying the state gross

retail or use tax, commits a Class B misdemeanor per IC 6-2.5-9-1.

_________________________________________________________

________________________________

Seller’s Signature

Date

Seller Instructions:

Mail to:

• All lines must be completed or exemption is invalid. Dealer may

Indiana Department of Revenue

be held responsible for the sales tax if form is not fully complet-

Desk Audit – Mail Stop 104

ed.

100 N. Senate Ave.

• Keep a copy of the ST-137RV for dealer documentation of

Indianapolis, IN 46204

exemption.

• Mail the original ST-137RV to the Department of Revenue at

the address shown within thirty (30) days of delivery.

1

1 2

2