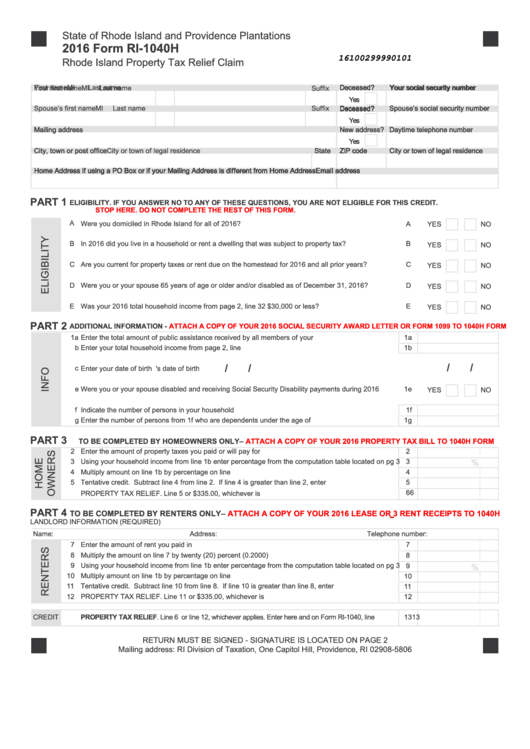

State of Rhode Island and Providence Plantations

2016 Form RI-1040H

16100299990101

Rhode Island Property Tax Relief Claim

First name

MI

Last name

Deceased?

Deceased?

Deceased?

Your social security number

Your social security number

Your social security number

Your first name

MI

Last name

Suffix

Yes

Yes

Spouse’s first name

MI

Last name

Suffix

Deceased?

Spouse’s social security number

Spouse’s social security number

Deceased?

Yes

Yes

Mailing address

Mailing address

New address?

New address?

Daytime telephone number

Daytime telephone number

Yes

Yes

City, town or post office

City, town or post office

State

State

ZIP code

ZIP code

ZIP code

City or town of legal residence

City or town of legal residence

City or town of legal residence

Home Address if using a PO Box or if your Mailing Address is different from Home Address

Home Address if using a PO Box or if your Mailing Address is different from Home Address

Home Address if using a PO Box or if your Mailing Address is different from Home Address

Home Address if using a PO Box or if your Mailing Address is different from Home Address

Email address

Email address

Email address

Email address

PART 1

ELIGIBILITY. IF YOU ANSWER NO TO ANY OF THESE QUESTIONS, YOU ARE NOT ELIGIBLE FOR THIS CREDIT.

STOP HERE.

DO NOT COMPLETE THE REST OF THIS FORM.

A

Were you domiciled in Rhode Island for all of 2016?..................................................................................

A

YES

NO

B

In 2016 did you live in a household or rent a dwelling that was subject to property tax?............................

B

YES

NO

C

Are you current for property taxes or rent due on the homestead for 2016 and all prior years?.................

C

YES

NO

D

Were you or your spouse 65 years of age or older and/or disabled as of December 31, 2016?................

D

YES

NO

E

Was your 2016 total household income from page 2, line 32 $30,000 or less?..........................................

E

YES

NO

PART 2

ADDITIONAL INFORMATION -

ATTACH A COPY OF YOUR 2016 SOCIAL SECURITY AWARD LETTER OR FORM 1099 TO 1040H FORM

1 a

Enter the total amount of public assistance received by all members of your household...........................

1a

b

Enter your total household income from page 2, line 32............................................................................. 1b

/

/

/

/

c

Enter your date of birth ............................

1d Enter spouse's date of birth .....................

e

Were you or your spouse disabled and receiving Social Security Disability payments during 2016 ..........

1e

YES

NO

Indicate the number of persons in your household .....................................................................................

1f

f

g

Enter the number of persons from 1f who are dependents under the age of 18........................................

1g

PART 3

TO BE COMPLETED BY HOMEOWNERS ONLY–

ATTACH A COPY OF YOUR 2016 PROPERTY TAX BILL TO 1040H FORM

2

Enter the amount of property taxes you paid or will pay for 2016...............................................................

2

Using your household income from line 1b enter percentage from the computation table located on pg 3

3

3

%

Multiply amount on line 1b by percentage on line 3....................................................................................

4

5

Tentative credit. Subtract line 4 from line 2. If line 4 is greater than line 2, enter zero..............................

5

6

6

PROPERTY TAX RELIEF. Line 5 or $335.00, whichever is LESS..............................................................

PART 4

TO BE COMPLETED BY RENTERS ONLY–

ATTACH A COPY OF YOUR 2016 LEASE OR 3 RENT RECEIPTS TO 1040H

LANDLORD INFORMATION (REQUIRED)

Name:

Address:

Telephone number:

7

Enter the amount of rent you paid in 2016..................................................................................................

7

8

Multiply the amount on line 7 by twenty (20) percent (0.2000) ....................................................................

8

9

Using your household income from line 1b enter percentage from the computation table located on pg 3

9

%

10

Multiply amount on line 1b by percentage on line 9.................................................................................... 10

11

Tentative credit. Subtract line 10 from line 8. If line 10 is greater than line 8, enter zero..........................

11

12

PROPERTY TAX RELIEF. Line 11 or $335.00, whichever is LESS............................................................ 12

CREDIT

13

PROPERTY TAX RELIEF. Line 6 or line 12, whichever applies. Enter here and on Form RI-1040, line 14c....... 13

RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

1

1 2

2 3

3