Provident Fund Withdrawl Notification Form

ADVERTISEMENT

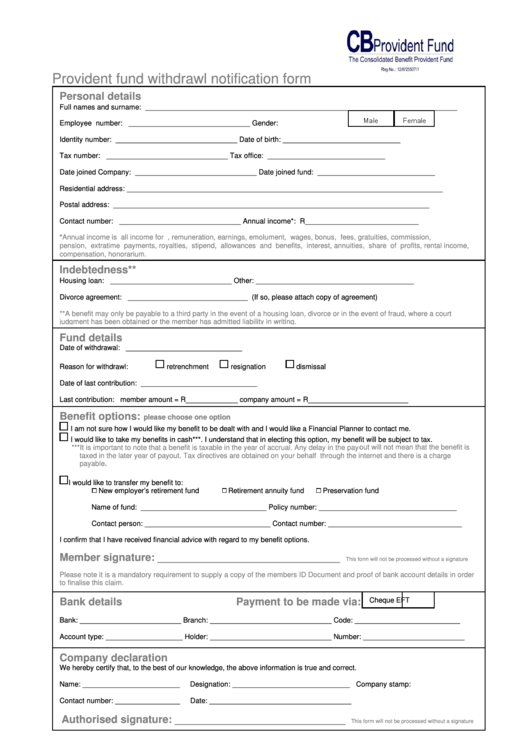

Provident fund withdrawl notification form

Personal details

Full names and surname:

_____________________________________________________________________________

Employee number:

______________________________

Gender:

M a l e

F e m a l e

Identity number:

______________________________

Date of birth:

_____________________________

Tax number:

______________________________

Tax office:

_____________________________

Date joined Company:

______________________________ Date joined fund:

_____________________________

Residential address:

______________________________________________________________________________

Postal address:

______________________________________________________________________________

Contact number:

______________________________

Annual income*:

R____________________________

*Annual income is all income for e.g. salary, remuneration, earnings, emolument, wages, bonus, fees, gratuities, commission,

pension, extratime payments, royalties, stipend, allowances and benefits, interest, annuities, share of profits, rental income,

compensation, honorarium.

Indebtedness**

Housing loan:

______________________________

Other: _______________________________________

Divorce agreement:

______________________________ (If so, please attach copy of agreement)

**A benefit may only be payable to a third party in the event of a housing loan, divorce or in the event of fraud, where a court

judgment has been obtained or the member has admitted liability in writing.

Fund details

Date of withdrawal:

_____________________________

Reason for withdrawl:

retrenchment

resignation

dismissal

Date of last contribution:

_____________________________

Last contribution:

member amount = R_____________

company amount = R_________________________

Benefit options:

please choose one option

I am not sure how I would like my benefit to be dealt with and I would like a Financial Planner to contact me.

I would like to take my benefits in cash***. I understand that in electing this option, my benefit will be subject to tax.

***It is important to note that a benefit is taxable in the year of accrual. Any delay in the pay-out will not mean that the benefit is

taxed in the later year of payout. Tax directives are obtained on your behalf through the internet and there is a charge

payable.

I would like to transfer my benefit to:

New employer’s retirement fund

Retirement annuity fund

Preservation fund

Name of fund:

_______________________________ Policy number: __________________________________

Contact person:

_______________________________ Contact number: _________________________________

I confirm that I have received financial advice with regard to my benefit options.

Member signature: _______________________________

This form will not be processed without a signature

Please note it is a mandatory requirement to supply a copy of the members ID Document and proof of bank account details in order

to finalise this claim.

Bank details

Payment to be made via:

Cheque

EFT

Bank: _________________________

Branch: ______________________________

Code: __________________________

Account type: ___________________

Holder: ______________________________

Number: _________________________

Company declaration

We hereby certify that, to the best of our knowledge, the above information is true and correct.

Name: ________________________

Designation: _____________________________ Company stamp:

Contact number: ________________

Date: ___________________________________

Authorised signature: _____________________________

This form will not be processed without a signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1