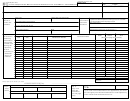

P r o p e r t y T a x

D e a l e r ’ s M o t o r V e h i c l e I n v e n t o r y T a x S t a t e m e n t / C o n f i d e n t i a l

Form 50-246

Instructions

If you are an owner of an inventory subject to Sec. 23.121, Tax Code, you

Step 3: Information on each vehicle sold during the reporting month.

must file this dealer’s motor vehicle inventory tax statement as required by

Complete the information on each motor vehicle sold, including the

Sec. 23.122.

date of sale, model year, model make, vehicle identification number,

purchaser’s name, type of sale, sales price and unit property tax. The

Filing deadlines: You must file this statement on or before the 10th day of

footnotes include:

each month. If you were not in business for the entire year, you must file this

1

statement each month after your business opens, but you do not include

Type of Sale: Place one of the following codes by each sale reported:

any tax payment until the beginning of the next calendar year. You are

MM - motor vehicle inventory - sales of motor vehicles. A motor

presumed to have started business on the date you were issued a dealer’s

vehicle is a fully self-propelled vehicle with at least two wheels which

general distinguishing number. The chief appraiser, however, has sole

has the primary purpose fo transporting people or property and

discretion to designate a different starting date. However, if your dealership

includes a towable recreationa vehicle. Motor vehicle does not include

was the purchaser of an existing dealership and you have a contract with the

equipment or machinery designed and intended for a specific work

prior owner to pay the current year motor vehicle inventory taxes owed, then

related purpose other than transporting people or property. Only this

you must notify the chief appraiser and the county tax assessor-collector of

type of sale has a unit property tax value (see below).

this contract and continue to pay the monthly tax payment. Be sure to keep

a completed copy of the statement for your files and a blank copy of the

FL - fleet sales - motor vehicles included in the sale of five or more

form for each month’s filing.

motor vehicles from your inventory to the same buyer within one

calendar year.

Filing places: You must file the original statement with your monthly tax

payment with the county tax assessor-collector. You must file a copy of

DL - dealer sales - sales of vehicles to another Texas dealer or dealer

the original completed statement with the county appraisal district’s chief

who is legally recognized in another state as a motor vehicle dealer.

appraiser. The addresses and phone numbers for both offices are at the top

of the form. Texas Department of Transportation has authority to view this

SS - subsequent sales - dealer-financed sales of motor vehicles

form in auditing dealer license compliance.

that, at the time of sale, have dealer financing from your motor vehicle

inventory in this same calendar year. The first sale of a dealer-financed

Filing penalties: Late filing incurs a penalty of 5 percent of the amount

vehicle is reported as a motor vehicle inventory sale, with sale of this

due. If the amount is not paid within 10 days after the due date, the penalty

same vehicle later in the year classified as a subsequent sale.

increases for an additional penalty of 5 percent of the amount due. Failure

to file this form is a misdemeanor offense punishable by a fine not to exceed

2

Sales Price: The price as set forth on the Application for Certificate of

$100. Each day that you fail to comply is a separate offense. In addition, a

Title, or would appear if that form was used.

tax lien attaches to your business personal property to secure the penalty’s

3

Unit Property Tax: To compute, multiply the sales price by the unit

payment. The district attorney, criminal district attorney, county attorney,

property tax factor. For fleet, dealer and subsequent sales that are

collector or a peraon designated by the collector shall collect the penalty,

not included in the net motor vehicle inventory, the unit property tax is

with action in the county in which you maintain your principal place of

$-0-. The unit property tax factor is the aggregate tax rate divided by

business or residence. You also will forfeit a penalty of $500 for each month

12 and then by $100. Calculate your aggregate tax rate by adding the

or part of a month in which this statement is not filed after it is due.

property tax rates for all taxing units in which the inventory is located.

Annual property tax bill: You will receive a separate tax bill(s) for your

Use the property tax rates for the year preceding the year in which the

motor vehicle inventory for each taxing unit that taxes your property, usually

vehicle is sold. If the county aggregate tax rate is expressed in dollars

in October. The county tax assessor-collector also will receive a copy of

per $100 of valuation, divide by $100 and then divide by 12. Dividing

the tax bill(s) and will pay each taxing unit from your escrow account. If

the aggregate rate by 12 yields a monthly tax rate and by $100 to a

your escrow account is not sufficient to pay the taxes owed, the county tax

rate per $1 of sales price.

assessor-collector will send you a tax receipt for the partial payment and a

4

Total Unit Property Tax for This Month: Enter only on last page of

tax bill for the amount of the deficiency. You must send to the county tax

monthly statement.

assessor-collector the balance of total tax owed. You may not withdraw

funds from your escrow account.

Step 4: Total sales. Provide totals on last page of statement of the

number of units and the sales amounts for vehicles sold in each category.

Step 1: Owner’s name and address. Give the corporate, sole

proprietorship or partnership’s name, including mailing address and

Step 5: Sign the form. Sign and enter the date if you are the person

telephone number of the actual business location required by the

completing this statement.

monthlhy statement (not of the owner). Give the person’s name and title

that completed the statement.

Step 2: Information about the business. Give the address of the actual

physical location of the business. Include your business’ name and the

account number from the appraisal district’s notices.

For more information, visit our Web site:

50-246 • 09-09/8 • Page 3

1

1 2

2 3

3