The Ers Form 1099-R - 2016

ADVERTISEMENT

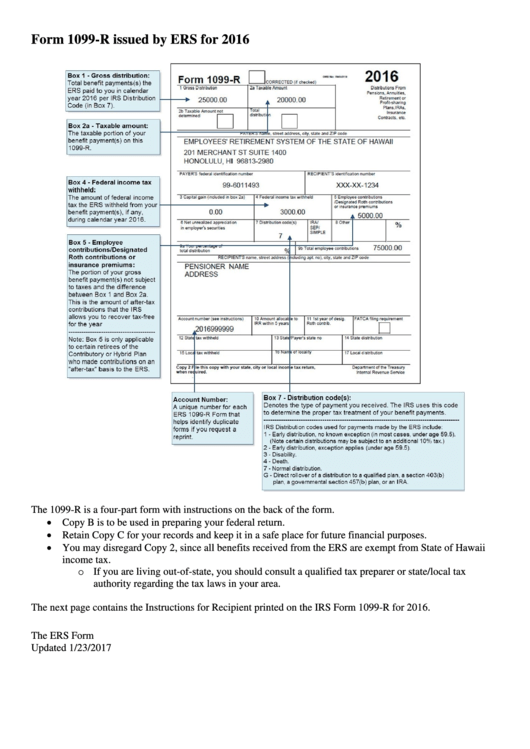

Form 1099-R issued by ERS for 2016

The 1099-R is a four-part form with instructions on the back of the form.

Copy B is to be used in preparing your federal return.

Retain Copy C for your records and keep it in a safe place for future financial purposes.

You may disregard Copy 2, since all benefits received from the ERS are exempt from State of Hawaii

income tax.

o If you are living out-of-state, you should consult a qualified tax preparer or state/local tax

authority regarding the tax laws in your area.

The next page contains the Instructions for Recipient printed on the IRS Form 1099-R for 2016.

The ERS Form 1099-2016.doc

Updated 1/23/2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2