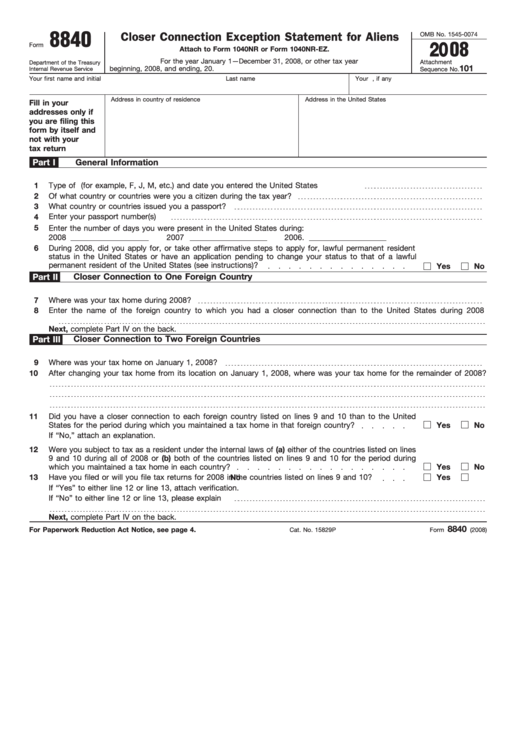

8840

Closer Connection Exception Statement for Aliens

OMB No. 1545-0074

Form

2008

Attach to Form 1040NR or Form 1040NR-EZ.

For the year January 1—December 31, 2008, or other tax year

Attachment

Department of the Treasury

101

beginning

, 2008, and ending

, 20

.

Internal Revenue Service

Sequence No.

Your first name and initial

Last name

Your U.S. taxpayer identification number, if any

Address in country of residence

Address in the United States

Fill in your

addresses only if

you are filing this

form by itself and

not with your U.S.

tax return

Part I

General Information

1

Type of U.S. visa (for example, F, J, M, etc.) and date you entered the United States

2

Of what country or countries were you a citizen during the tax year?

3

What country or countries issued you a passport?

Enter your passport number(s)

4

5

Enter the number of days you were present in the United States during:

2008

2007

2006

.

6

During 2008, did you apply for, or take other affirmative steps to apply for, lawful permanent resident

status in the United States or have an application pending to change your status to that of a lawful

permanent resident of the United States (see instructions)?

Yes

No

Closer Connection to One Foreign Country

Part II

7

Where was your tax home during 2008?

Enter the name of the foreign country to which you had a closer connection than to the United States during 2008

8

Next, complete Part IV on the back.

Closer Connection to Two Foreign Countries

Part III

Where was your tax home on January 1, 2008?

9

10

After changing your tax home from its location on January 1, 2008, where was your tax home for the remainder of 2008?

11

Did you have a closer connection to each foreign country listed on lines 9 and 10 than to the United

States for the period during which you maintained a tax home in that foreign country?

Yes

No

If “No,” attach an explanation.

12

Were you subject to tax as a resident under the internal laws of (a) either of the countries listed on lines

9 and 10 during all of 2008 or (b) both of the countries listed on lines 9 and 10 for the period during

which you maintained a tax home in each country?

Yes

No

13

Have you filed or will you file tax returns for 2008 in the countries listed on lines 9 and 10?

Yes

No

If “Yes” to either line 12 or line 13, attach verification.

If “No” to either line 12 or line 13, please explain

Next, complete Part IV on the back.

8840

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 15829P

Form

(2008)

1

1 2

2 3

3 4

4