RESET FORM

PRINT FORM

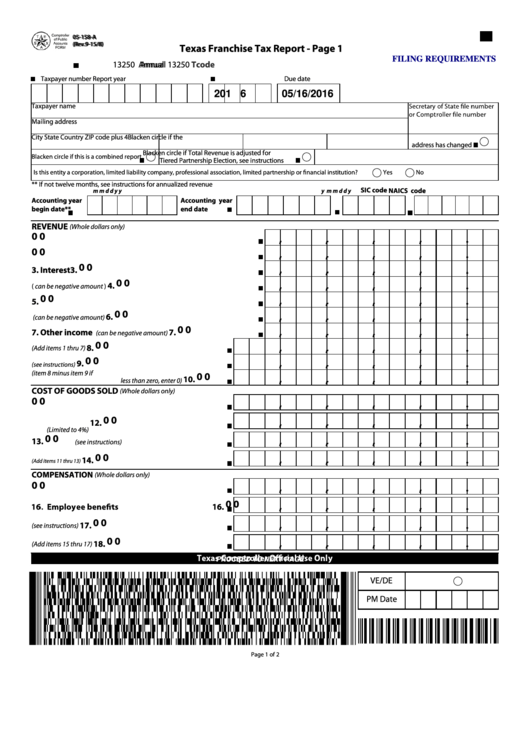

05-158-A

05-158-A

(Rev.9-15/8)

(Rev.9-15/8)

Texas Franchise Tax Report - Page 1

FILING REQUIREMENTS

Tcode

13250

13250 Annual

Annual

Taxpayer number

Report year

Due date

2 0 1 6

05/16/2016

Taxpayer name

Mailing address

City

State

Country

ZIP code plus 4

Blacken circle if the

address has changed

Blacken circle if Total Revenue is adjusted for

Blacken circle if this is a combined report

Tiered Partnership Election, see instructions

Is this entity a corporation, limited liability company, professional association, limited partnership or nancial institution?

Yes

No

** If not twelve months, see instructions for annualized revenue

SIC code

NAICS code

m

m

d

d

y

y

m

m

d

d

y

y

Accounting year

Accounting year

begin date**

end date

REVENUE

(Whole dollars only)

0 0

1. Gross receipts or sales

1.

0 0

2. Dividends

2.

0 0

3. Interest

3.

0 0

4. Rents

4.

( can be negative amount )

0 0

5. Royalties

5.

0 0

6. Gains/losses

6.

(can be negative amount)

0 0

7. Other income

7.

(can be negative amount)

0 0

8. Total gross revenue

8.

(Add items 1 thru 7)

0 0

9. Exclusions from gross revenue

9.

(see instructions)

(item 8 minus item 9 if

0 0

10. TOTAL REVENUE

10.

less than zero, enter 0)

COST OF GOODS SOLD

(Whole dollars only)

0 0

11. Cost of goods sold

11.

0 0

12. Indirect or administrative overhead costs

12.

(Limited to 4%)

0 0

13. Other

13.

(see instructions)

0 0

14. TOTAL COST OF GOODS SOLD

14.

(Add items 11 thru 13)

COMPENSATION

(Whole dollars only)

0 0

15. Wages and cash compensation

15.

0 0

16.

0 0

17. Other

17.

(see instructions)

0 0

18. TOTAL COMPENSATION

18.

(Add items 15 thru 17)

PROCEED TO NEXT PAGE

VE/DE

PM Date

Page 1 of 2

1

1 2

2