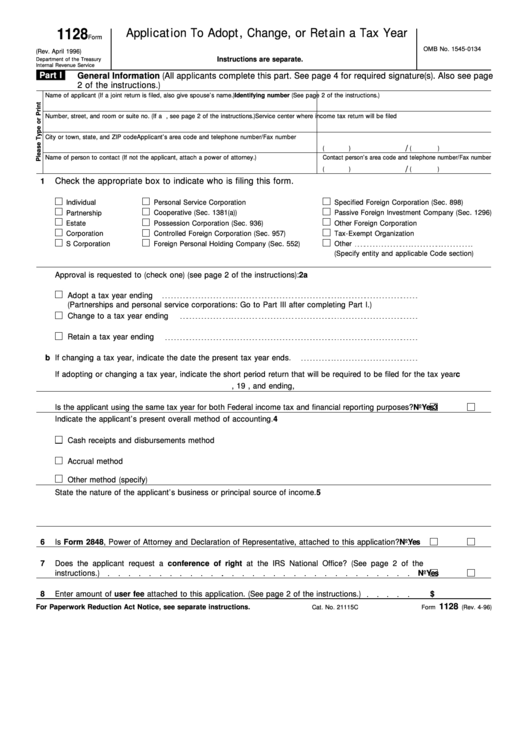

Form 1128 Application To Adopt, Change, Or Retain A Tax Year

ADVERTISEMENT

1128

Application To Adopt, Change, or Retain a Tax Year

Form

OMB No. 1545-0134

(Rev. April 1996)

Instructions are separate.

Department of the Treasury

Internal Revenue Service

Part I

General Information (All applicants complete this part. See page 4 for required signature(s). Also see page

2 of the instructions.)

Name of applicant (If a joint return is filed, also give spouse’s name.)

Identifying number (See page 2 of the instructions.)

Number, street, and room or suite no. (If a P.O. box, see page 2 of the instructions.)

Service center where income tax return will be filed

City or town, state, and ZIP code

Applicant’s area code and telephone number/Fax number

/

(

)

(

)

Name of person to contact (If not the applicant, attach a power of attorney.)

Contact person’s area code and telephone number/Fax number

/

(

)

(

)

Check the appropriate box to indicate who is filing this form.

1

Individual

Personal Service Corporation

Specified Foreign Corporation (Sec. 898)

Partnership

Cooperative (Sec. 1381(a))

Passive Foreign Investment Company (Sec. 1296)

Estate

Possession Corporation (Sec. 936)

Other Foreign Corporation

Corporation

Tax-Exempt Organization

Controlled Foreign Corporation (Sec. 957)

Other

S Corporation

Foreign Personal Holding Company (Sec. 552)

(Specify entity and applicable Code section)

2a

Approval is requested to (check one) (see page 2 of the instructions):

Adopt a tax year ending

(Partnerships and personal service corporations: Go to Part III after completing Part I.)

Change to a tax year ending

Retain a tax year ending

b

If changing a tax year, indicate the date the present tax year ends.

c

If adopting or changing a tax year, indicate the short period return that will be required to be filed for the tax year

beginning

, 19

, and ending

, 19

.

3

Is the applicant using the same tax year for both Federal income tax and financial reporting purposes?

Yes

No

4

Indicate the applicant’s present overall method of accounting.

Cash receipts and disbursements method

Accrual method

Other method (specify)

5

State the nature of the applicant’s business or principal source of income.

6

Is Form 2848, Power of Attorney and Declaration of Representative, attached to this application?

Yes

No

7

Does the applicant request a conference of right at the IRS National Office? (See page 2 of the

instructions.)

Yes

No

8

Enter amount of user fee attached to this application. (See page 2 of the instructions.)

$

1128

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 21115C

Form

(Rev. 4-96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4