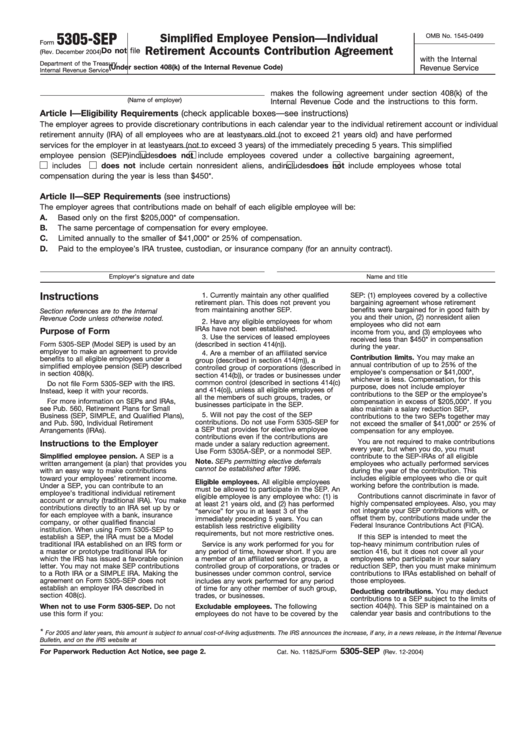

5305-SEP

OMB No. 1545-0499

Simplified Employee Pension—Individual

Form

Retirement Accounts Contribution Agreement

Do not file

(Rev. December 2004)

with the Internal

Department of the Treasury

(Under section 408(k) of the Internal Revenue Code)

Revenue Service

Internal Revenue Service

makes the following agreement under section 408(k) of the

(Name of employer)

Internal Revenue Code and the instructions to this form.

Article I—Eligibility Requirements (check applicable boxes—see instructions)

The employer agrees to provide discretionary contributions in each calendar year to the individual retirement account or individual

retirement annuity (IRA) of all employees who are at least

years old (not to exceed 21 years old) and have performed

services for the employer in at least

years (not to exceed 3 years) of the immediately preceding 5 years. This simplified

employee pension (SEP)

includes

does not include employees covered under a collective bargaining agreement,

includes

does not include certain nonresident aliens, and

includes

does not include employees whose total

compensation during the year is less than $450*.

Article II—SEP Requirements (see instructions)

The employer agrees that contributions made on behalf of each eligible employee will be:

A.

Based only on the first $205,000* of compensation.

B.

The same percentage of compensation for every employee.

C.

Limited annually to the smaller of $41,000* or 25% of compensation.

D.

Paid to the employee’s IRA trustee, custodian, or insurance company (for an annuity contract).

Employer’s signature and date

Name and title

Instructions

1. Currently maintain any other qualified

SEP: (1) employees covered by a collective

retirement plan. This does not prevent you

bargaining agreement whose retirement

from maintaining another SEP.

benefits were bargained for in good faith by

Section references are to the Internal

you and their union, (2) nonresident alien

Revenue Code unless otherwise noted.

2. Have any eligible employees for whom

employees who did not earn U.S. source

IRAs have not been established.

Purpose of Form

income from you, and (3) employees who

3. Use the services of leased employees

received less than $450* in compensation

Form 5305-SEP (Model SEP) is used by an

(described in section 414(n)).

during the year.

employer to make an agreement to provide

4. Are a member of an affiliated service

Contribution limits. You may make an

benefits to all eligible employees under a

group (described in section 414(m)), a

annual contribution of up to 25% of the

simplified employee pension (SEP) described

controlled group of corporations (described in

employee’s compensation or $41,000*,

in section 408(k).

section 414(b)), or trades or businesses under

whichever is less. Compensation, for this

common control (described in sections 414(c)

Do not file Form 5305-SEP with the IRS.

purpose, does not include employer

and 414(o)), unless all eligible employees of

Instead, keep it with your records.

contributions to the SEP or the employee’s

all the members of such groups, trades, or

For more information on SEPs and IRAs,

compensation in excess of $205,000*. If you

businesses participate in the SEP.

see Pub. 560, Retirement Plans for Small

also maintain a salary reduction SEP,

5. Will not pay the cost of the SEP

Business (SEP, SIMPLE, and Qualified Plans),

contributions to the two SEPs together may

contributions. Do not use Form 5305-SEP for

and Pub. 590, Individual Retirement

not exceed the smaller of $41,000* or 25% of

a SEP that provides for elective employee

Arrangements (IRAs).

compensation for any employee.

contributions even if the contributions are

You are not required to make contributions

Instructions to the Employer

made under a salary reduction agreement.

every year, but when you do, you must

Use Form 5305A-SEP, or a nonmodel SEP.

Simplified employee pension. A SEP is a

contribute to the SEP-IRAs of all eligible

Note. SEPs permitting elective deferrals

employees who actually performed services

written arrangement (a plan) that provides you

cannot be established after 1996.

with an easy way to make contributions

during the year of the contribution. This

includes eligible employees who die or quit

toward your employees’ retirement income.

Eligible employees. All eligible employees

Under a SEP, you can contribute to an

working before the contribution is made.

must be allowed to participate in the SEP. An

employee’s traditional individual retirement

Contributions cannot discriminate in favor of

eligible employee is any employee who: (1) is

account or annuity (traditional IRA). You make

highly compensated employees. Also, you may

at least 21 years old, and (2) has performed

contributions directly to an IRA set up by or

not integrate your SEP contributions with, or

“service” for you in at least 3 of the

for each employee with a bank, insurance

offset them by, contributions made under the

immediately preceding 5 years. You can

company, or other qualified financial

Federal Insurance Contributions Act (FICA).

establish less restrictive eligibility

institution. When using Form 5305-SEP to

requirements, but not more restrictive ones.

establish a SEP, the IRA must be a Model

If this SEP is intended to meet the

traditional IRA established on an IRS form or

Service is any work performed for you for

top-heavy minimum contribution rules of

a master or prototype traditional IRA for

any period of time, however short. If you are

section 416, but it does not cover all your

which the IRS has issued a favorable opinion

a member of an affiliated service group, a

employees who participate in your salary

letter. You may not make SEP contributions

controlled group of corporations, or trades or

reduction SEP, then you must make minimum

to a Roth IRA or a SIMPLE IRA. Making the

businesses under common control, service

contributions to IRAs established on behalf of

agreement on Form 5305-SEP does not

includes any work performed for any period

those employees.

establish an employer IRA described in

of time for any other member of such group,

Deducting contributions. You may deduct

section 408(c).

trades, or businesses.

contributions to a SEP subject to the limits of

section 404(h). This SEP is maintained on a

When not to use Form 5305-SEP. Do not

Excludable employees. The following

calendar year basis and contributions to the

use this form if you:

employees do not have to be covered by the

*

For 2005 and later years, this amount is subject to annual cost-of-living adjustments. The IRS announces the increase, if any, in a news release, in the Internal Revenue

Bulletin, and on the IRS website at

5305-SEP

For Paperwork Reduction Act Notice, see page 2.

Cat. No. 11825J

Form

(Rev. 12-2004)

1

1 2

2