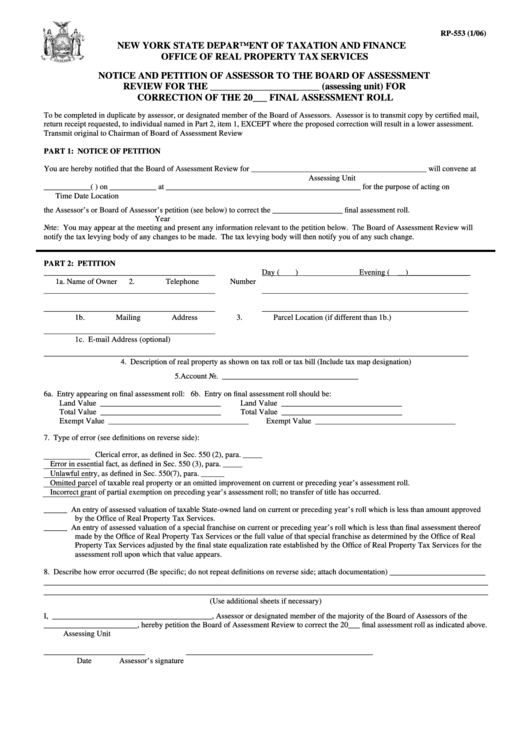

RP-553 (1/06)

NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

NOTICE AND PETITION OF ASSESSOR TO THE BOARD OF ASSESSMENT

REVIEW FOR THE _______________________ (assessing unit) FOR

CORRECTION OF THE 20___ FINAL ASSESSMENT ROLL

To be completed in duplicate by assessor, or designated member of the Board of Assessors. Assessor is to transmit copy by certified mail,

return receipt requested, to individual named in Part 2, item 1, EXCEPT where the proposed correction will result in a lower assessment.

Transmit original to Chairman of Board of Assessment Review

PART 1: NOTICE OF PETITION

You are hereby notified that the Board of Assessment Review for _____________________________________________ will convene at

Assessing Unit

____________(a.m./p.m.) on ____________ at __________________________________________________ for the purpose of acting on

Time

Date

Location

the Assessor’s or Board of Assessor’s petition (see below) to correct the __________________ final assessment roll.

Year

Note: You may appear at the meeting and present any information relevant to the petition below. The Board of Assessment Review will

notify the tax levying body of any changes to be made. The tax levying body will then notify you of any such change.

PART 2: PETITION

____________________________________________

Day (

)

Evening ( __)________________

1a. Name of Owner

2. Telephone Number

____________________________________________

_____________________________________________________

____________________________________________

_____________________________________________________

1b. Mailing Address

3. Parcel Location (if different than 1b.)

____________________________________________

1c. E-mail Address (optional)

_____________________________________________________________________________________________________________

4. Description of real property as shown on tax roll or tax bill (Include tax map designation)

5.

Account No. ___________________________________

6a. Entry appearing on final assessment roll:

6b. Entry on final assessment roll should be:

Land Value _______________________________

Land Value _______________________________

Total Value _______________________________

Total Value _______________________________

Exempt Value ____________________________________

Exempt Value ____________________________________

7. Type of error (see definitions on reverse side):

Clerical error, as defined in Sec. 550 (2), para. _____

Error in essential fact, as defined in Sec. 550 (3), para. _____

Unlawful entry, as defined in Sec. 550(7), para. ______

Omitted parcel of taxable real property or an omitted improvement on current or preceding year’s assessment roll.

Incorrect grant of partial exemption on preceding year’s assessment roll; no transfer of title has occurred.

______ An entry of assessed valuation of taxable State-owned land on current or preceding year’s roll which is less than amount approved

by the Office of Real Property Tax Services.

______ An entry of assessed valuation of a special franchise on current or preceding year’s roll which is less than final assessment thereof

made by the Office of Real Property Tax Services or the full value of that special franchise as determined by the Office of Real

Property Tax Services adjusted by the final state equalization rate established by the Office of Real Property Tax Services for the

assessment roll upon which that value appears.

______________________

8. Describe how error occurred (Be specific; do not repeat definitions on reverse side; attach documentation)

______________________________________________________________________________________________________

______________________________________________________________________________________________________

(Use additional sheets if necessary)

I, _________________________________________, Assessor or designated member of the majority of the Board of Assessors of the

________________________, hereby petition the Board of Assessment Review to correct the 20___ final assessment roll as indicated above.

Assessing Unit

__________________________

________________________________________________

Date

Assessor’s signature

1

1 2

2