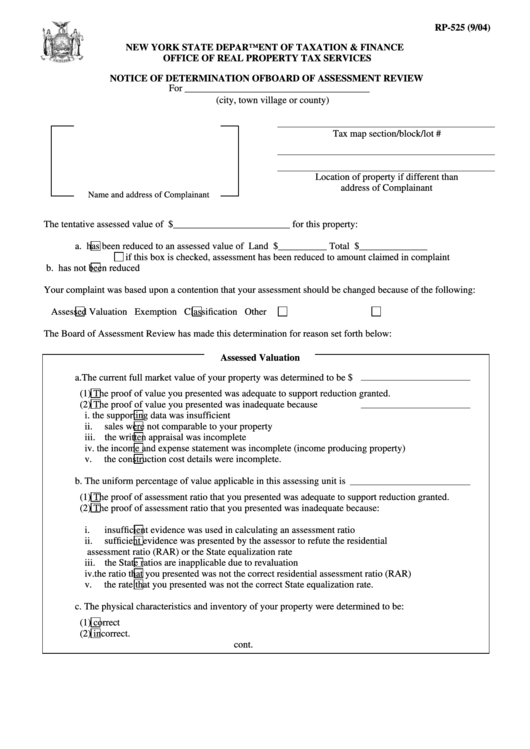

RP-525 (9/04)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

NOTICE OF DETERMINATION OF BOARD OF ASSESSMENT REVIEW

For ______________________________________

(city, town village or county)

Tax map section/block/lot #

Location of property if different than

address of Complainant

Name and address of Complainant

The tentative assessed value of $________________________ for this property:

a.

has been reduced to an assessed value of Land $__________ Total $______________

if this box is checked, assessment has been reduced to amount claimed in complaint

b.

has not been reduced

Your complaint was based upon a contention that your assessment should be changed because of the following:

Assessed Valuation

Exemption

Classification

Other

The Board of Assessment Review has made this determination for reason set forth below:

Assessed Valuation

a. The current full market value of your property was determined to be $

(1)

The proof of value you presented was adequate to support reduction granted.

(2)

The proof of value you presented was inadequate because

i.

the supporting data was insufficient

ii.

sales were not comparable to your property

iii. the written appraisal was incomplete

iv. the income and expense statement was incomplete (income producing property)

v.

the construction cost details were incomplete.

b. The uniform percentage of value applicable in this assessing unit is

(1)

The proof of assessment ratio that you presented was adequate to support reduction granted.

(2)

The proof of assessment ratio that you presented was inadequate because:

i.

insufficient evidence was used in calculating an assessment ratio

ii.

sufficient evidence was presented by the assessor to refute the residential

assessment ratio (RAR) or the State equalization rate

iii. the State ratios are inapplicable due to revaluation

iv. the ratio that you presented was not the correct residential assessment ratio (RAR)

v.

the rate that you presented was not the correct State equalization rate.

c. The physical characteristics and inventory of your property were determined to be:

(1)

correct

(2)

incorrect.

cont.

1

1 2

2