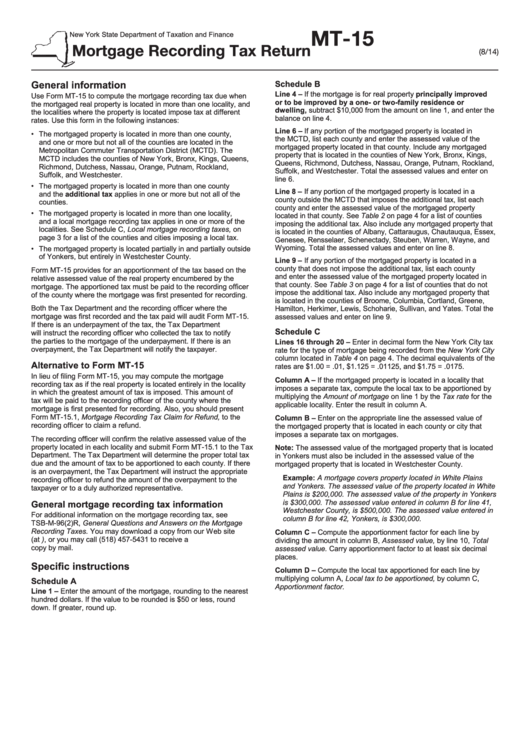

Form Mt-15 - Mortgage Recording Tax Return

ADVERTISEMENT

MT-15

New York State Department of Taxation and Finance

Mortgage Recording Tax Return

(8/14)

General information

Schedule B

Line 4 – If the mortgage is for real property principally improved

Use Form MT-15 to compute the mortgage recording tax due when

or to be improved by a one- or two-family residence or

the mortgaged real property is located in more than one locality, and

dwelling, subtract $10,000 from the amount on line 1, and enter the

the localities where the property is located impose tax at different

balance on line 4.

rates. Use this form in the following instances:

Line 6 – If any portion of the mortgaged property is located in

• The mortgaged property is located in more than one county,

the MCTD, list each county and enter the assessed value of the

and one or more but not all of the counties are located in the

mortgaged property located in that county. Include any mortgaged

Metropolitan Commuter Transportation District (MCTD). The

property that is located in the counties of New York, Bronx, Kings,

MCTD includes the counties of New York, Bronx, Kings, Queens,

Queens, Richmond, Dutchess, Nassau, Orange, Putnam, Rockland,

Richmond, Dutchess, Nassau, Orange, Putnam, Rockland,

Suffolk, and Westchester. Total the assessed values and enter on

Suffolk, and Westchester.

line 6.

• The mortgaged property is located in more than one county

Line 8 – If any portion of the mortgaged property is located in a

and the additional tax applies in one or more but not all of the

county outside the MCTD that imposes the additional tax, list each

counties.

county and enter the assessed value of the mortgaged property

• The mortgaged property is located in more than one locality,

located in that county. See Table 2 on page 4 for a list of counties

and a local mortgage recording tax applies in one or more of the

imposing the additional tax. Also include any mortgaged property that

localities. See Schedule C, Local mortgage recording taxes, on

is located in the counties of Albany, Cattaraugus, Chautauqua, Essex,

page 3 for a list of the counties and cities imposing a local tax.

Genesee, Rensselaer, Schenectady, Steuben, Warren, Wayne, and

Wyoming. Total the assessed values and enter on line 8.

• The mortgaged property is located partially in and partially outside

of Yonkers, but entirely in Westchester County.

Line 9 – If any portion of the mortgaged property is located in a

county that does not impose the additional tax, list each county

Form MT-15 provides for an apportionment of the tax based on the

and enter the assessed value of the mortgaged property located in

relative assessed value of the real property encumbered by the

that county. See Table 3 on page 4 for a list of counties that do not

mortgage. The apportioned tax must be paid to the recording officer

impose the additional tax. Also include any mortgaged property that

of the county where the mortgage was first presented for recording.

is located in the counties of Broome, Columbia, Cortland, Greene,

Both the Tax Department and the recording officer where the

Hamilton, Herkimer, Lewis, Schoharie, Sullivan, and Yates. Total the

mortgage was first recorded and the tax paid will audit Form MT-15.

assessed values and enter on line 9.

If there is an underpayment of the tax, the Tax Department

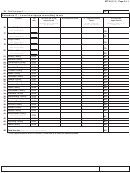

Schedule C

will instruct the recording officer who collected the tax to notify

the parties to the mortgage of the underpayment. If there is an

Lines 16 through 20 – Enter in decimal form the New York City tax

overpayment, the Tax Department will notify the taxpayer.

rate for the type of mortgage being recorded from the New York City

column located in Table 4 on page 4. The decimal equivalents of the

Alternative to Form MT-15

rates are $1.00 = .01, $1.125 = .01125, and $1.75 = .0175.

In lieu of filing Form MT-15, you may compute the mortgage

Column A – If the mortgaged property is located in a locality that

recording tax as if the real property is located entirely in the locality

imposes a separate tax, compute the local tax to be apportioned by

in which the greatest amount of tax is imposed. This amount of

multiplying the Amount of mortgage on line 1 by the Tax rate for the

tax will be paid to the recording officer of the county where the

applicable locality. Enter the result in column A.

mortgage is first presented for recording. Also, you should present

Form MT-15.1, Mortgage Recording Tax Claim for Refund, to the

Column B – Enter on the appropriate line the assessed value of

recording officer to claim a refund.

the mortgaged property that is located in each county or city that

imposes a separate tax on mortgages.

The recording officer will confirm the relative assessed value of the

property located in each locality and submit Form MT-15.1 to the Tax

Note: The assessed value of the mortgaged property that is located

Department. The Tax Department will determine the proper total tax

in Yonkers must also be included in the assessed value of the

due and the amount of tax to be apportioned to each county. If there

mortgaged property that is located in Westchester County.

is an overpayment, the Tax Department will instruct the appropriate

Example: A mortgage covers property located in White Plains

recording officer to refund the amount of the overpayment to the

and Yonkers. The assessed value of the property located in White

taxpayer or to a duly authorized representative.

Plains is $200,000. The assessed value of the property in Yonkers

is $300,000. The assessed value entered in column B for line 41,

General mortgage recording tax information

Westchester County, is $500,000. The assessed value entered in

For additional information on the mortgage recording tax, see

column B for line 42, Yonkers, is $300,000.

TSB-M-96(2)R, General Questions and Answers on the Mortgage

Recording Taxes. You may download a copy from our Web site

Column C – Compute the apportionment factor for each line by

(at ), or you may call (518) 457-5431 to receive a

dividing the amount in column B, Assessed value, by line 10, Total

copy by mail.

assessed value. Carry apportionment factor to at least six decimal

places.

Specific instructions

Column D – Compute the local tax apportioned for each line by

multiplying column A, Local tax to be apportioned, by column C,

Schedule A

Apportionment factor.

Line 1 – Enter the amount of the mortgage, rounding to the nearest

hundred dollars. If the value to be rounded is $50 or less, round

down. If greater, round up.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4