*SF2369*

SF2369/11-15

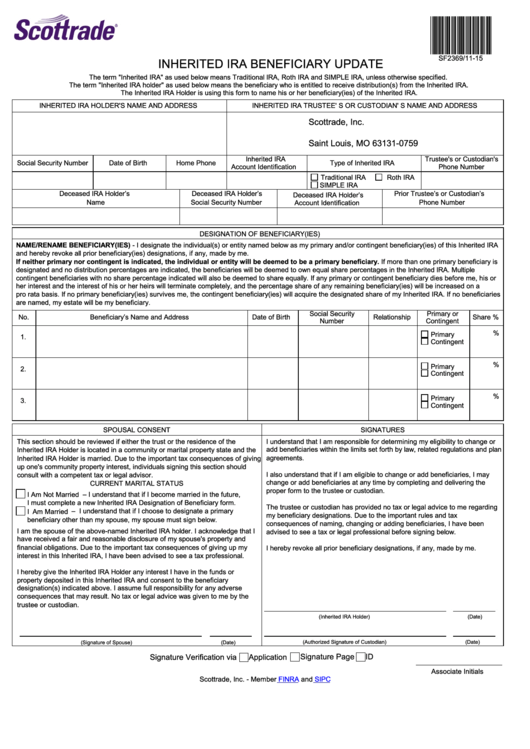

INHERITED IRA BENEFICIARY UPDATE

The term "Inherited IRA" as used below means Traditional IRA, Roth IRA and SIMPLE IRA, unless otherwise specified.

The term "Inherited IRA holder" as used below means the beneficiary who is entitled to receive distribution(s) from the Inherited IRA.

The Inherited IRA Holder is using this form to name his or her beneficiary(ies) of the Inherited IRA.

INHERITED IRA HOLDER'S NAME AND ADDRESS

INHERITED IRA TRUSTEE' S OR CUSTODIAN' S NAME AND ADDRESS

Scottrade, Inc.

P.O. Box 31759

Saint Louis, MO 63131-0759

Inherited IRA

Trustee's or Custodian's

Social Security Number

Date of Birth

Home Phone

Type of Inherited IRA

Account Identification

Phone Number

Traditional IRA

Roth IRA

SIMPLE IRA

Deceased IRA Holder’s

Deceased IRA Holder’s

Prior Trustee’s or Custodian’s

Deceased IRA Holder’s

Name

Social Security Number

Phone Number

Account Identification

DESIGNATION OF BENEFICIARY(IES)

NAME/RENAME BENEFICIARY(IES) - I designate the individual(s) or entity named below as my primary and/or contingent beneficiary(ies) of this Inherited IRA

and hereby revoke all prior beneficiary(ies) designations, if any, made by me.

If neither primary nor contingent is indicated, the individual or entity will be deemed to be a primary beneficiary. If more than one primary beneficiary is

designated and no distribution percentages are indicated, the beneficiaries will be deemed to own equal share percentages in the Inherited IRA. Multiple

contingent beneficiaries with no share percentage indicated will also be deemed to share equally. If any primary or contingent beneficiary dies before me, his or

her interest and the interest of his or her heirs will terminate completely, and the percentage share of any remaining beneficiary(ies) will be increased on a

pro rata basis. If no primary beneficiary(ies) survives me, the contingent beneficiary(ies) will acquire the designated share of my Inherited IRA. If no beneficiaries

are named, my estate will be my beneficiary.

Social Security

Primary or

No.

Beneficiary’s Name and Address

Date of Birth

Relationship

Share %

Number

Contingent

%

Primary

1.

Contingent

%

Primary

2.

Contingent

%

Primary

3.

Contingent

SPOUSAL CONSENT

SIGNATURES

I understand that I am responsible for determining my eligibility to change or

This section should be reviewed if either the trust or the residence of the

add beneficiaries within the limits set forth by law, related regulations and plan

Inherited IRA Holder is located in a community or marital property state and the

agreements.

Inherited IRA Holder is married. Due to the important tax consequences of giving

up one's community property interest, individuals signing this section should

I also understand that if I am eligible to change or add beneficiaries, I may

consult with a competent tax or legal advisor.

change or add beneficiaries at any time by completing and delivering the

CURRENT MARITAL STATUS

proper form to the trustee or custodian.

– I understand that if I become married in the future,

I Am Not Married

I must complete a new Inherited IRA Designation of Beneficiary form.

The trustee or custodian has provided no tax or legal advice to me regarding

I Am Married – I understand that if I choose to designate a primary

my beneficiary designations. Due to the important rules and tax

beneficiary other than my spouse, my spouse must sign below.

consequences of naming, changing or adding beneficiaries, I have been

I am the spouse of the above-named Inherited IRA holder. I acknowledge that I

advised to see a tax or legal professional before signing below.

have received a fair and reasonable disclosure of my spouse's property and

financial obligations. Due to the important tax consequences of giving up my

I hereby revoke all prior beneficiary designations, if any, made by me.

interest in this Inherited IRA, I have been advised to see a tax professional.

I hereby give the Inherited IRA Holder any interest I have in the funds or

property deposited in this Inherited IRA and consent to the beneficiary

designation(s) indicated above. I assume full responsibility for any adverse

consequences that may result. No tax or legal advice was given to me by the

trustee or custodian.

(Inherited IRA Holder)

(Date)

(Authorized Signature of Custodian)

(Date)

(Signature of Spouse)

(Date)

Signature Page

ID

Signature Verification via

Application

Associate Initials

Scottrade, Inc. - Member

FINRA

and

SIPC

1

1