Fixed Income Elections Form

Download a blank fillable Fixed Income Elections Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Fixed Income Elections Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

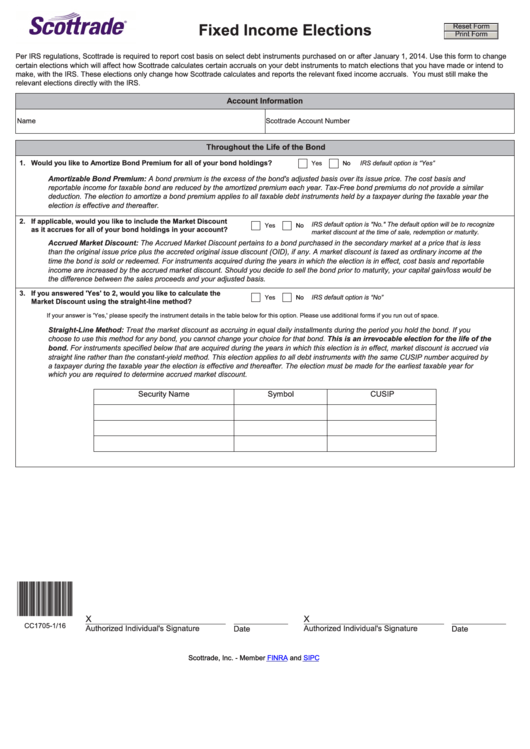

Fixed Income Elections

Reset Form

Print Form

Per IRS regulations, Scottrade is required to report cost basis on select debt instruments purchased on or after January 1, 2014. Use this form to change

certain elections which will affect how Scottrade calculates certain accruals on your debt instruments to match elections that you have made or intend to

make, with the IRS. These elections only change how Scottrade calculates and reports the relevant fixed income accruals. You must still make the

relevant elections directly with the IRS.

Account Information

Name

Scottrade Account Number

Throughout the Life of the Bond

1. Would you like to Amortize Bond Premium for all of your bond holdings?

IRS default option is “Yes”

Yes

No

Amortizable Bond Premium: A bond premium is the excess of the bond's adjusted basis over its issue price. The cost basis and

reportable income for taxable bond are reduced by the amortized premium each year. Tax-Free bond premiums do not provide a similar

deduction. The election to amortize a bond premium applies to all taxable debt instruments held by a taxpayer during the taxable year the

election is effective and thereafter.

2. If applicable, would you like to include the Market Discount

IRS default option is "No." The default option will be to recognize

Yes

No

as it accrues for all of your bond holdings in your account?

market discount at the time of sale, redemption or maturity.

Accrued Market Discount: The Accrued Market Discount pertains to a bond purchased in the secondary market at a price that is less

than the original issue price plus the accreted original issue discount (OID), if any. A market discount is taxed as ordinary income at the

time the bond is sold or redeemed. For instruments acquired during the years in which the election is in effect, cost basis and reportable

income are increased by the accrued market discount. Should you decide to sell the bond prior to maturity, your capital gain/loss would be

the difference between the sales proceeds and your adjusted basis.

3. If you answered 'Yes' to 2, would you like to calculate the

IRS default option is “No”

Yes

No

Market Discount using the straight-line method?

If your answer is 'Yes,' please specify the instrument details in the table below for this option. Please use additional forms if you run out of space.

Straight-Line Method: Treat the market discount as accruing in equal daily installments during the period you hold the bond. If you

choose to use this method for any bond, you cannot change your choice for that bond. This is an irrevocable election for the life of the

bond. For instruments specified below that are acquired during the years in which this election is in effect, market discount is accrued via

straight line rather than the constant-yield method. This election applies to all debt instruments with the same CUSIP number acquired by

a taxpayer during the taxable year the election is effective and thereafter. The election must be made for the earliest taxable year for

which you are required to determine accrued market discount.

Security Name

Symbol

CUSIP

*CC1705*

X

X

CC1705-1/16

Authorized Individual's Signature

Authorized Individual's Signature

Date

Date

Scottrade, Inc. - Member

FINRA

and

SIPC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1