Monthly Spending Plan

ADVERTISEMENT

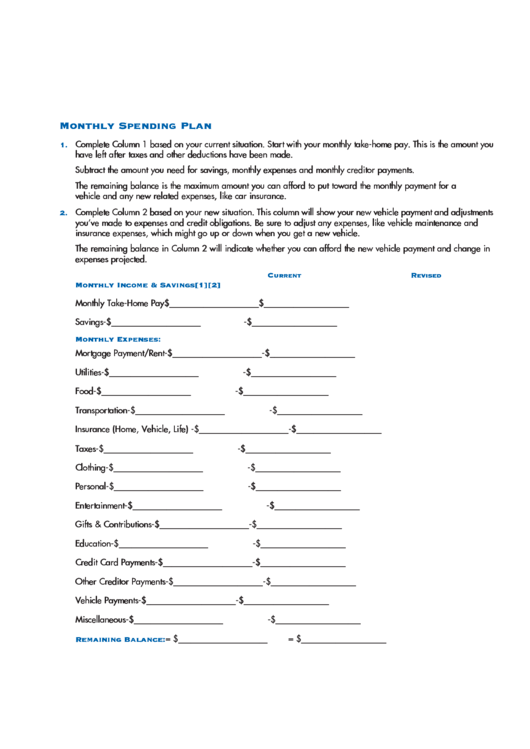

Monthly Spending Plan

Complete Column 1 based on your current situation. Start with your monthly take-home pay. This is the amount you

1.

have left after taxes and other deductions have been made.

Subtract the amount you need for savings, monthly expenses and monthly creditor payments.

The remaining balance is the maximum amount you can afford to put toward the monthly payment for a

vehicle and any new related expenses, like car insurance.

Complete Column 2 based on your new situation. This column will show your new vehicle payment and adjustments

2.

you’ve made to expenses and credit obligations. Be sure to adjust any expenses, like vehicle maintenance and

insurance expenses, which might go up or down when you get a new vehicle.

The remaining balance in Column 2 will indicate whether you can afford the new vehicle payment and change in

expenses projected.

C

R

URRENT

EVISED

Monthly Income & Savings

[1]

[2]

Monthly Take-Home Pay

$_____________________

$____________________

Savings

-$_____________________

-$____________________

Monthly Expenses:

Mortgage Payment/Rent

-$____________ _________

-$____________________

Utilities

-$____________ _________

-$____________________

Food

-$____________ _________

-$____________________

Transportation

-$____________ _________

-$____________________

Insurance (Home, Vehicle, Life)

-$____________ _________

-$____________________

Taxes

-$____________ _________

-$____________________

Clothing

-$____________ _________

-$____________________

Personal

-$____________ _________

-$____________________

Entertainment

-$____________ _________

-$____________________

Gifts & Contributions

-$____________ _________

-$____________________

Education

-$____________ _________

-$____________________

Credit Card Payments

-$____________ _________

-$____________________

Other Creditor Payments

-$____________ _________

-$____________________

Vehicle Payments

-$____________ _________

-$____________________

Miscellaneous

-$____________ _________

-$____________________

= $_____________________

= $______ ______________

Remaining Balance:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2