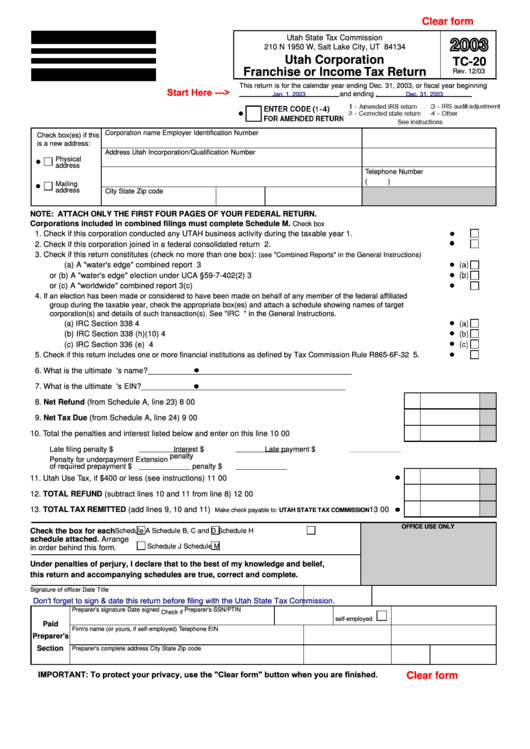

Clear form

Utah State Tax Commission

210 N 1950 W, Salt Lake City, UT 84134

Utah Corporation

TC-20

Franchise or Income Tax Return

Rev. 12/03

This return is for the calendar year ending Dec. 31, 2003, or fiscal year beginning

Start Here --->

Jan. 1, 2003

Dec. 31, 2003

and ending

.

Corporation name

Employer Identification Number

Check box(es) if this

is a new address:

Address

Utah Incorporation/Qualification Number

Physical

address

Telephone Number

(

)

Mailing

address

City

State

Zip code

NOTE: ATTACH ONLY THE FIRST FOUR PAGES OF YOUR FEDERAL RETURN.

Corporations included in combined filings must complete Schedule M.

Check box

1. Check if this corporation conducted any UTAH business activity during the taxable year ............................................

1.

2. Check if this corporation joined in a federal consolidated return ..................................................................................

2.

3. Check if this return constitutes (check no more than one box):

(see "Combined Reports" in the General Instructions)

(a) A "water's edge" combined report ....................................................................................................................

3

or (b) A "water's edge" election under UCA §59-7-402(2) ..........................................................................................

3

or (c) A "worldwide" combined report ........................................................................................................................

3(c)

4.

If an election has been made or considered to have been made on behalf of any member of the federal affiliated

group during the taxable year, check the appropriate box(es) and attach a schedule showing names of target

corporation(s) and details of such transaction(s). See "IRC Sections..." in the General Instructions.

(a) IRC Section 338 ...............................................................................................................................................

4

(b) IRC Section 338 (h)(10) ...................................................................................................................................

4

(c) IRC Section 336 (e) ..........................................................................................................................................

4

5.

Check if this return includes one or more financial institutions as defined by Tax Commission Rule R865-6F-32 .............

5.

6. What is the ultimate U.S. parent's name?

______________________________________________

7. What is the ultimate U.S. parent's EIN?

______________________________________________

8. Net Refund (from Schedule A, line 23) .................................................................................................

8

00

9. Net Tax Due (from Schedule A, line 24) ...............................................................................................

9

00

10. Total the penalties and interest listed below and enter on this line

......................................................

10

00

Late filing penalty

$

Interest

$

Late payment $

penalty

Penalty for underpayment

Extension

of required prepayment

$

penalty

$

11. Utah Use Tax, if $400 or less (see instructions) ..................................................................................

11

00

12. TOTAL REFUND (subtract lines 10 and 11 from line 8) .......................................................................

12

00

13. TOTAL TAX REMITTED (add lines 9, 10 and 11)

......

13

00

Make check payable to: UTAH STATE TAX COMMISSION

OFFICE USE ONLY

Check the box for each

Schedule A

Schedule B, C and D

Schedule H

schedule attached. Arrange

Schedule J

Schedule M

in order behind this form.

Under penalties of perjury, I declare that to the best of my knowledge and belief,

this return and accompanying schedules are true, correct and complete.

Signature of officer

Date

Title

Don't forget to sign & date this return before filing with the Utah State Tax Commission.

Preparer's signature

Date signed

Preparer's SSN/PTIN

Check if

self-employed

Paid

Firm's name (or yours, if self-employed)

Telephone

EIN

Preparer's

Section

Preparer's complete address

City

State

Zip code

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2 3

3 4

4 5

5 6

6 7

7