What Is Form 944?

Form 944 or the Employer’s Annual Federal Tax Return is an annual report of wages paid to employees and withholdings made by employers. Designed to counteract Form 941, Employer’s Quarterly Federal Tax Return, it allows small businesses to pay federal employment taxes once a year, instead of paying quarterly. This form is intended only for the smallest business – these are defined as employers whose overall employment tax payments do not exceed $1,000 a year.

Form 944-X, Adjusted Employer’s Annual Federal Tax Return or Claim for Refund is used to correct any mistakes made when filing Form 944. All 944 forms must be mailed to or e-filed at the IRS. Download the latest fillable version below.

What Is Form 944 Used for?

Employer’s Annual Federal Tax Return is used to report federal income tax and Social Security and Medicare taxes on employees' salaries.

All 944 forms must be filed so that the IRS can reconcile wages and withholdings and process tax payments. Failure to file these forms properly and in due time may lead to penalties and interest incurred by the employer.

Filing Form 944 means you are only responsible for reporting taxes once annually instead of four times a year.

Who Files Form 944?

Certain qualifying small employers that pay wages to their staff and withhold taxes must file a 944 form on an annual basis. The IRS will provide you with a written notice if you are qualified as eligible to file Form 944. Those who not receive any written notification must file Form 941 quarterly as per usual.

Form 944 is only applicable to small businesses with a yearly liability for federal income taxes of no more than $1,000 and an estimate of paid wages of less than $4,100.

Some new employers might also be allowed to file Form 944. Before you hire any staff, you must apply for an EIN - the Employer Identification Number - which will then be used to identify your business when reporting and paying taxes. When applying for the Employer Identification Number via Form SS-4, complete Box 13 and check Box 14, indicating that your employment tax liability is predicted to be $1,000 or less.

You cannot file Form 944 in the following cases:

- If the IRS did not specifically notify you in writing;

- If you employ only household or agricultural staff;

- If you request to file Form 944 and receive no reply from the IRS.

You must file and submit Form 941 in all aforementioned cases.

IRS Form 944 Instructions

All 944 Forms are filed annually by January 31, to report wages and withholdings from the previous year. Any entity eligible to file this form can register and file form 944 online at the official IRS website.

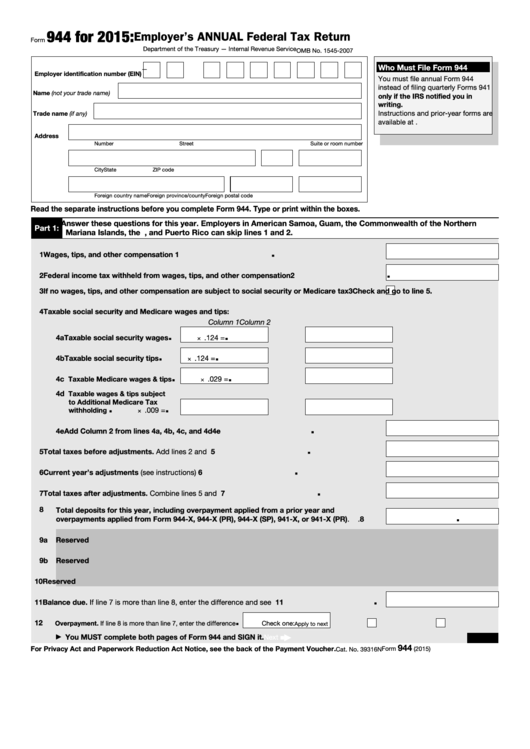

To successfully file Form 944, you must enter your Employer Identification Number, business name, trade name (if applicable), and address. Then, you must input information about wages and other compensation, withheld federal income tax, and taxable Social Security and Medicare wages.

Form 944 reporting information includes:

- Wages, tips, and other compensation paid to employees;

- Federal income tax withheld;

- Employer and employee shares of Medicare and Social Security taxes;

- Current year’s adjustments;

- Qualified small business payroll tax credit for increasing research activities;

- Balance due and any overpayment.

How to file form 944

Form 944 is filed either online with the help of an authorized IRS e-file provider or by mail. If you decide to e-file, the third-party provider will require you to pay a fee. An e-filed form is received and processed much faster than forms sent by mail.

Those who choose to file by mail must pay close attention to the IRS’s guidelines. The IRS will treat Form 944 as filed on time even when received after the due date if it is properly addressed, has enough postage, and is postmarked by the U.S. Postal Service or IRS-designated delivery service on or before the due date.

Form 944 Templates

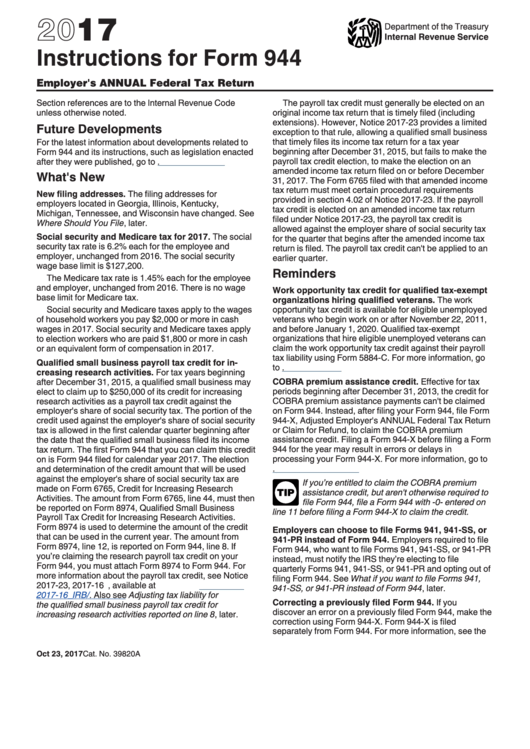

Instructions For Form 944 - Employer's Annual Federal Tax Return - 2017

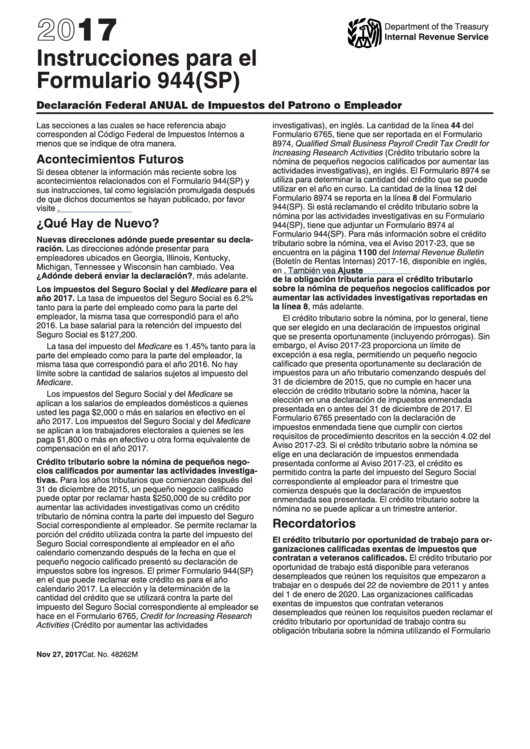

Formulario 944(sp) - Declaracion Federal Anual De Impuestos Del Patrono O Empleador - 2016

Formulario 944-pr - Planilla Para La Declaracion Federal Anual Del Patrono - 2011

Form 944-x - Adjusted Employer's Annual Federal Tax Return Or Claim For Refund - 2015